ESG’S DATA MANAGEMENT CHALLENGES

The acquisition of any supporting data has become the building block of any sensible ESG strategy.

A plethora of rating providers and data aggregators (RPDA), as well as different third parties, have produced proprietary implementations to fit their needs by leveraging various relevant thematic groupings to propel their products. Capturing the momentum and the increased appetite of consumers and shareholders, the regulators are primarily focused on how to streamline the increasing necessity of proof. The acquisition of any supporting data has become the building block of any sensible ESG strategy. Without proof and empirical data any attempts to defend and support any ESG claim can be easily viewed as ‘greenwashing’ strategy or in some cases be viewed as deception.

At the highest level, the data groupings that are sought are derived by the UN 17 Sustainable Development Goals (SDGs). However, the main challenge with the SDGs is that these are mainly goals as suggested by their name and they do not include a framework with a set of metrics to facilitate any desired auditable income. In addition, corporate leadership may decide to choose their own views on critical ESG factors. Regardless of the measures chosen, management board and corporate executives will eventually need all supporting qualitative and quantitative data to enable any ESG measurement and fine tune their corporate strategy in order to achieve the desired results.

UN 17 Sustainable Development Goals:

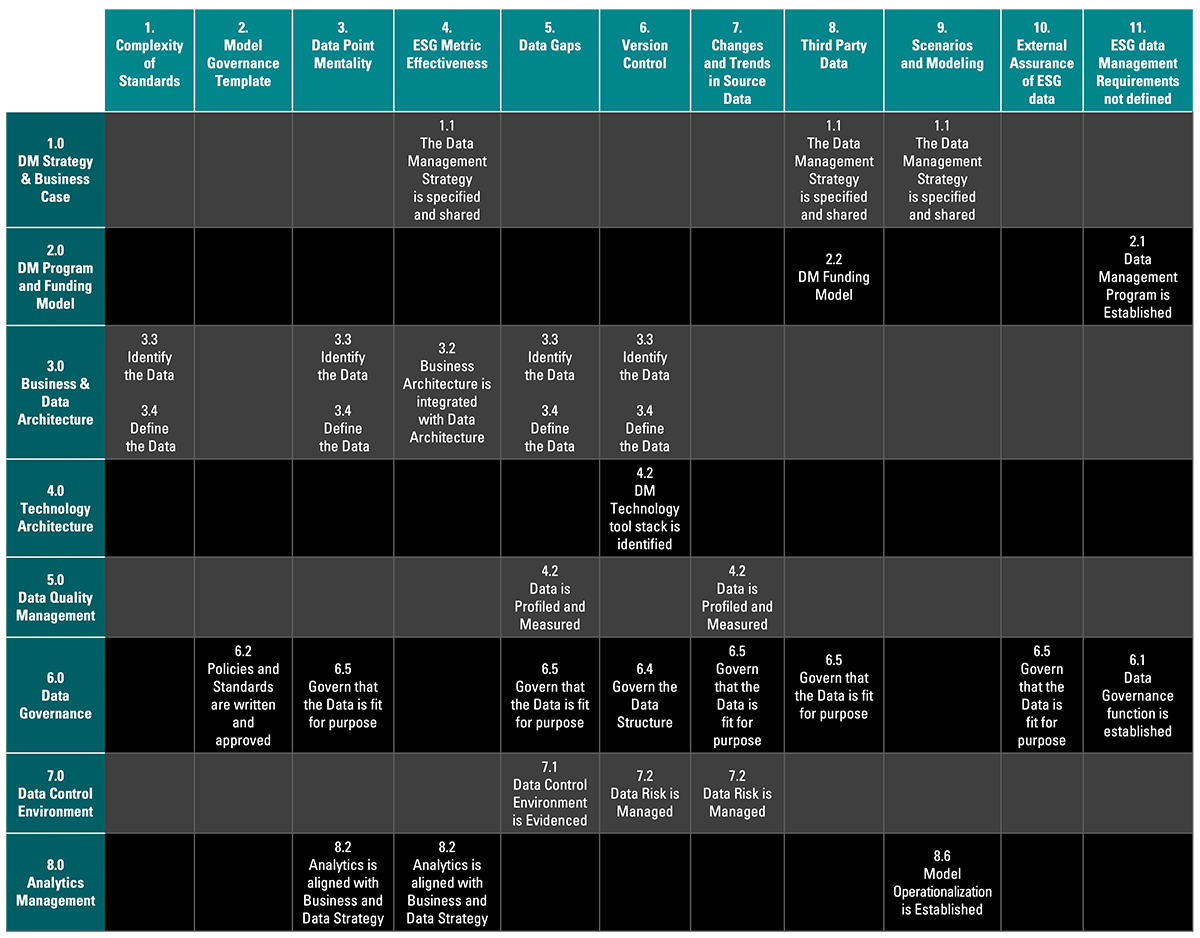

The deep dive and analysis by the ESG Working Group of the EDM Council study1 identified 11 current challenges, summarized also at the end of the section which are typical to the broader ESG data supply chain and resonate with the RPDA community, which are also mapped to the Data Capability Assessment Model (DCAM).

The data management challenges related to ESG data are no different than that of any emerging technology experience in the data supply chain encountered in the past. In this sense, ESG data needs to be treated like any other data. Data is a critical asset and a key differentiator for the enterprise to evolve and keep its competitive advantage. As the challenges are common, the recommended approach to address these challenges is the same. Existing data management tools should be enhanced and scaled to support ESG data challenges.

EDM Council summarized the ESG challenges as:

To achieve a comprehensive view of its ESG performance, a company generally needs data to support a multi-faceted analysis of enterprise-wide view of the value chain, along with the regulations, public commitments, timeline, cost, and budget implications. This will allow it to produce a holistic picture with priorities in mind, allowing the company to create synergies.

ESG data framework for the enterprise:

Overall, it is important to keep the following principles2 in mind:

At the high level, the ESG delivery process is characterized by a six-step framework, starting with specifying the requirement, acquiring the data, modeling the data, producing relevant and agreed upon metrics, overlaying any proprietary data before publishing the rating or the aggregated data set for consumption.

Depending on the type of ESG information required, the appropriate data level and source should be identified to determine the desired combination of any proprietary in-house data gathering and third-party data. Capco’s research has identified three main levels of information to be sourced:

Once the required view of underlying ESG data and its level of detail have been determined in line with the corporate ESG needs, then the next step can be approached: determining if the data can be completely in-house, or if third-party solutions must be utilized. If the latter, there will be the added to step to identify a representative list of vendors that can provide all the different data types that could be brought to the company. Cost will presumably play a significant role in the decision to bring in this data, which makes the prioritization and ranking of these data types even more important as the ESG agenda will most likely be met and delivered in staggered approach.

Regardless of the source of data (proprietary or purchased), the various constraints and claims supporting this data should be tested thoroughly to address the gap between the customer needs and availability of the underlying data sets. It is naïve to think that someone is currently capturing all the ESG data on downstream client and customers the financial service companies need which creates a disconnect in the data value chain that needs to be mitigated.

Since reporting of ESG data is a relatively new process and related requirements are growing rapidly, it is necessary to evaluate the quality of the data provided by each source. ESG standards vary greatly across geography and industry making it difficult to provide a normal distribution.

With the rise in demand and relevance of ESG data, firms have emerged that focus solely on ESG data (i.e. Arabesque, Covalence, Goby, et al). These firms provide techniques for assessing ESG factors, grading methodologies and risk analysis tools.

As the regulatory environment is changing, the stakes are getting higher. Due to its complex, dynamic and constantly increasing scope, the ESG data landscape is turning to be challenging for firms to identify, traverse or map. ESG is becoming the “industry standard” as consumers gravitate towards brands that address ESG issues in ways that align with their own values. As ESG reporting continues to evolve, firms that innovate more quickly will race ahead. The tasks of scoping ESG data requirements based on the level of detail and type of information required, will likely lead to the findings and understanding of how and where third-party data should be used.

Recommendations for financial organizations to advance the ESG agenda and stay abreast of the curve include:

1. EDM Council: ESG Data Management: Rating Providers and Data Aggregators

2. EDM Council: ESG Data Management for Corporate Reporting Entities, 2021