VIEW GERMAN LANGUAGE VERSION HERE

The introduction of agile practices, methods, and culture in the financial services industry has contributed significantly to accelerating product development, improving customer experience and optimizing core processes as well as facilitating faster responses to changing market conditions and regulatory requirements.

However, applying agile practices throughout all tasks of an organization for the sake of a fully agile environment often proves counterproductive. The key to driving and implementing an efficient and effective agile culture is by establishing the degree of agility a business unit needs, based on its scope of tasks, specific goals, potential areas of friction, and how each unit wants to position itself within these areas.

Achieving the highest level of agile maturity is not the ultimate goal. Rather, it is determining the optimal level of agility that suits a business unit’s specific objectives, challenges, context, and tasks. Even within a unit, there will be varying degrees of complexity, variability, and needs, which will require different trade-offs between speed, quality and cost. There is no one-size-fits-all solution for increasing agility. A tailored approach is required that considers specific characteristics and challenges.

Before creating and executing an agile agenda, a thorough agility assessment of business units needs to be carried out, to achieve the following:

The results of the assessment are likely to vary for each business unit. As an example of the prerequisites for conducting a successful agility assessment, we present an overview and results of a recently carried out agility assessment for an insurance company.

Our insurance client, the largest insurer in Germany, was already working on an implementation of a comprehensive agile agenda. The starting point for the assessment was the assumption that all companies operate under conflicting requirements, particularly in the areas of hierarchy vs. self-organization, efficiency vs. adaptability and stability vs. change. In each case, agility can be located very close to one of the poles of the respective area of friction, i.e. self-organization, adaptability or change.

Our agility assessment used a questionnaire designed along the following five dimensions: leadership, collaboration, organization structure, processes, and (agile) methods and events.

Method

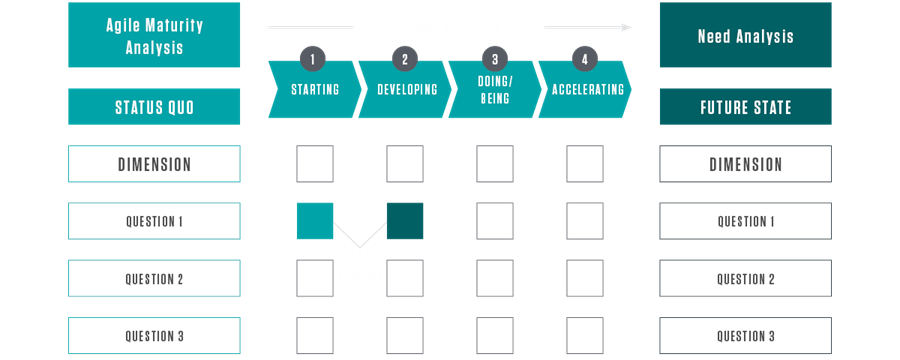

Sample agility assessment template

We assessed agile maturity on four levels – starting, developing, doing/being and accelerating agility. The questions were asked in regard to both the current situation (agile maturity analysis) and the respective target state (need for agility). The deviation between the agile ‘as is’ and ‘should be’ values was then examined via a gap analysis, with the extent of the deviations serving as an initial indicator of the need for action.

Key findings

The results of the agility assessment confirmed the initial hypothesis that a "go all-in on agility" was not desired. They also showed that some units had a different starting position along the agile maturity path to what had been anticipated, and in some cases higher than previously thought, which eliminated or decreased the need for agile processes. Lastly, the assessment revealed that units also had different needs for the maximum agile value of the future state. The units with the desired maturity value substantially higher than the starting value (e.g. 4 vs. 1) were prioritized for agile development.

From the client’s point of view, it was then considered undesirable to focus fully on agility, as a new picture emerged regarding the need for agility. For example, while strategic tasks required more process flexibility (target agile maturity level 3) and this was already being done (current agile maturity level 3), there was still a need for operational tasks to have a more adaptable and customer-oriented process design (target agile maturity level 3), which had not yet been implemented (current agile maturity level 2). These results helped shape a new agility agenda for our client, refocusing and reprioritizing their objectives and accelerating change.

Conclusion

Agility can be beneficial, but it should be applied where it can truly enhance efficiency, rather than for its own sake. A careful evaluation can identify areas that need agile approaches and solutions versus those that require stable processes. Prioritizing what should be done first and allocating time and budget accordingly will further aid the success of an agile transformation.

Capco helps clients with initiating or accelerating agile transformations.

Our agility assessment methodology will help you identify the areas that would benefit from agile approaches and to what degree. We will help you analyze and interpret the results, based on our extensive experience of agile transformation programs at major financial services clients.

Contact us to find out more about how we can support you with developing and implementing an action plan to optimize agility levels in your organization.