Regulators are asking banks to perform climate stress tests to keep the financial industry on track with the Paris Agreement. To this end, the ECB climate stress test introduces important building blocks in terms of climate related data and models. Although no capital requirements have been set in relation to the outcome of these tests, banks must develop and enhance their models and data practices to be able to assess risks on a broad array of exposures.

In the first half of 2022, the ECB is conducting their first bottom-up climate risk stress tests to assess the banks’ capabilities and best practices regarding climate risk assessment1. The tests aim to identify risk drivers and integrate them into financial risk models by means of qualitative and quantitative approaches structured in three modules:

I) Module 1 is a qualitative questionnaire composed of 11 thematic areas spread across 78 questions to systematically assess the status quo and stress testing capabilities of banks. It explores the climate risk stress tests governance and risk appetite, integration of stress tests into the long-term business strategy, stress tests methodology, scenarios and assumptions, future plans and the internal audit function.

II) Module 2 focuses on providing insights into the banks’ income sensitivity to transition risk, exposure to carbon-intensive industries, and the overall sustainability. It does so by asking for the interest, fees and commission income from greenhouse gas intensive industries as well as the calculations of financed GHG emissions.

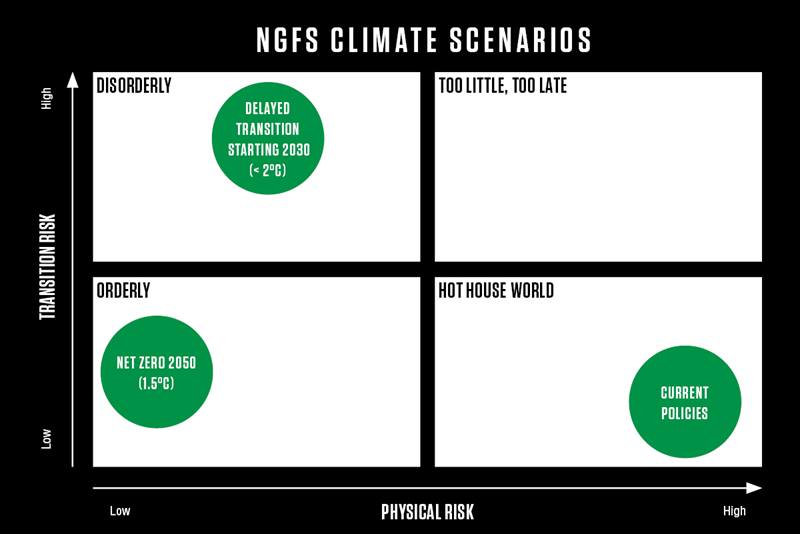

III) Lastly, module 3 promises to be the most challenging part of bottom-up stress tests as it investigates transition, physical and operational risks under three NGFS scenarios. The ECB provides banks with starting point values, macro-economic parameters as well as climate data.

Figure 1 illustrates that the NGFS ‘orderly’ scenario is preferable with the lowest risks, whereas the ‘disorderly’ scenario would result in the greatest transition risk and the ‘hot house world’ would result in the greatest physical risk.

Figure 1. Risk overview of the three NGFS climate stress test scenarios

Figure 2 provides an overview of module 3 bottom-up stress test and its scope.

Figure 2. Overview of the bottom-up stress test in module 3.

Expect gaps that will need fixing. Considering the specificities of the data required for this exercise, banks will certainly have gaps that would need to be addressed. For instance, in regard to the corporate loan portfolio, banks need to collect carbon data, location data and qualitative data about the infrastructures and business models and technologies used by clients (including capex, sales and costs data). This needs to be supported by a robust data strategy to meet regulatory requirements as well as integrating external data and standardizing the data collection processes.

Models and capabilities will benefit from an upgrade. The translation of physical events to physical risk is a cumbersome task that requires not only climate data, e.g., EPC data, but also the mapping of exposures, hazards and vulnerabilities with damage functions. Although the ECB intends to provide this through flood maps and NACE codes, banks should think about developing their capabilities and models for best performance.

Use the opportunity to offer new products and reduce risk. Banks can transform the challenge into an opportunity by reducing risks, for example through developing “green finance”, which could be giving customers additional funding at attractive rates to improve property energy efficiency.

Once the tests have been completed, the aggregate results are expected to be published by the ECB in July 2022. The output of this exercise will then be qualitatively integrated into the Supervisory Review and Evaluation Process (SREP). Additionally, the results are expected to form a fundamental part of the EBA’s guideline on ESG Risk Management which are expected to be finalized in December 2022. Going forward, these outcomes will need to be put into action, under the regulator’s continuous watch.

1 European Central Bank, 2022, “ECB Banking Supervision launches 2022 climate risk stress test”.