French financial institutions subject to ECB and/or EBA supervision must be ready to adopt the new NACE Rev. 2.1 statistical classification system for economic activities from the beginning of 2026. More than just a code update, this changes impacts risk management, ESG reporting and compliance strategies across the board – and has significant operational implications that institutions must prepare for now to avoid compliance failures or disruptions.

On June 30, the European Central Bank and the European Banking Authority confirmed that banks subject to reporting under ECB Regulations and/or the EBA supervisory reporting framework shall apply the new NACE Rev. 2.1 classification starting from January 1, 2026. The intention is to drive essential harmonization to reduce costs for banks and to enhance the analytical quality of reported data, including prudential and statistical reports such as FINREP and AnaCredit.

While most EU countries kickstarted this transition in January 2025, France is in the rearguard of market adoption. With just a few months to go, delaying preparations could lead to compliance risks, resource bottlenecks and operational disruptions, and institutions should start aligning systems, updating codes, and planning for mapping complexities, immediately.

What is NACE?

The European Union’s official classification system for economic activities, NACE (Nomenclature statistique des activités économiques dans la Communauté européenne) plays a foundational role in regulatory reporting, economic statistics, risk management and ESG disclosures. NACE codes are used to categorize economic sectors across the EU, providing a standardized way to track economic activities and set financial regulatory requirements. Codes vary from 1-digit classes: least granular (eg: Electricity, gas, steam and air conditioning supply) to 4-digit classes: most granular (eg: Production of electricity from non-renewable sources).

Following an in-depth assessment by the EBA-ECB Joint Bank Reporting Committee (JBRC) of the implications for European statistical, supervisory, and resolution reporting frameworks, in June it was announced that from January 2026 all amounts reported with a NACE breakdown should be calculated using Rev. 2.1 classification and reported as such in the relevant framework, data points and templates.

As the JBRC notes: “This ensures that any complex recalculations to obtain the equivalent amount under the former Rev. 2 classification are avoided… [and] amounts reported under the statistical and prudential reporting frameworks are consistently calculated using the same classification and therefore comparable.”

What is changing with Rev. 2.1?

The Rev. 2.1 update reshapes classifications to reflect today’s economic and technological realities. Key changes include the following:

• 36 new 4-digit classes – increasing from 615 to 651

• Mergers and splits – in sectors such as agriculture and the wood industry, impacting loan portfolios and sector exposure reporting

• Clearer ESG distinction – differentiating renewable vs. non-renewable energy sources for greater transparency in sustainability reporting

• New service categories – including intermediation in retail and real estate, impacting firms in these sectors as regulations evolve

• Greater granularity in digital and IT activities – reflecting the growth of tech-driven sectors and expansion of data-related services.

These changes impact multiple operational areas:

• Regulatory reporting. AnaCredit (monthly, 4-digit codes) – ECB has zero tolerance for misclassified codes

• Client onboarding. Code segregation – avoid data contamination between legacy and new codes

• IT & data management. Dual-code referential – required for parallel reporting through 2026

• Risk & compliance. ESG & credit risk alignment – supports CSRD/SFDR-aligned disclosures

• Group transformation. NAF (Nomenclature d'activités française)/NACE user identification – ensures readiness across all impacted systems.

The mapping challenge – 1:1 vs 1:N

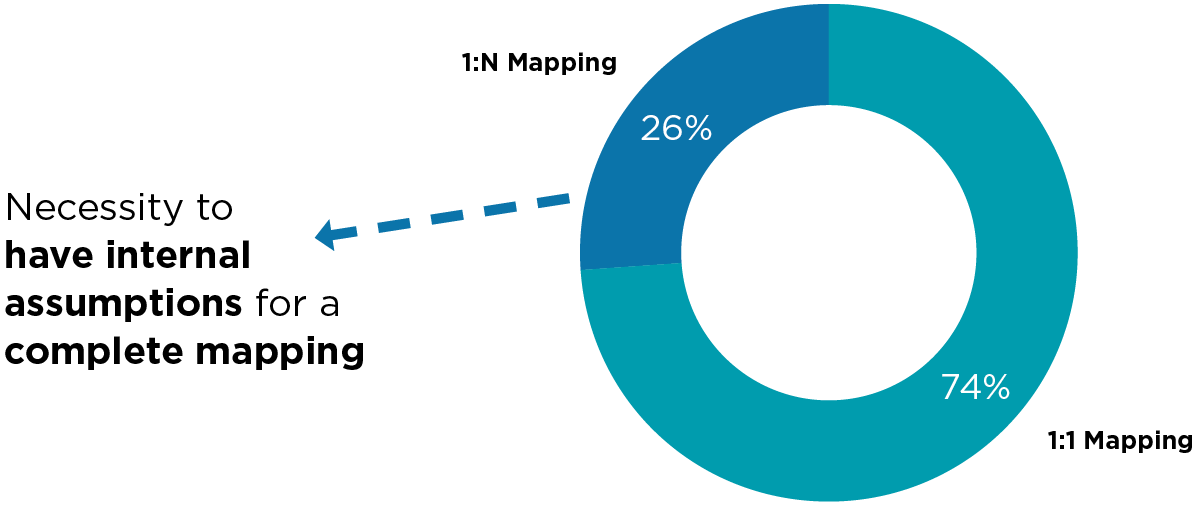

As institutions look to revise their coding structure, one of the biggest challenges is mapping existing Rev. 2 codes to the new taxonomy.

• 74% of mappings are 1:1 (source: Eurostat) – one old NACE code maps directly to one new code

• 26% are 1:N – one old NACE code maps to multiple new codes, requiring careful, context-sensitive decisions by financial institutions when assigning the new codes.

It is critical for institutions to plan ahead and ensure accurate mapping and must ensure they have the right data management capabilities to handle such scenarios accurately, particularly when mapping to multiple new codes. For institutions handling large volumes of transactions and diverse client portfolios, getting the mapping correct is vital to avoid errors.

A 6-Step roadmap to compliance

Avoiding potential compliance pitfalls requires a structured approach, and below we share a practical roadmap to help navigate the transition with confidence.

- Awareness & Governance: Kick off a lean, cross-functional program with clear roles

- Inventory & Gap Analysis: Identify where NAF/NACE is used and access dual-code readiness

- Regulatory Testing: Run dry duns (e.g. Anacredit) and validate NAF/NACE across workflows

- Data & System Updates: Set up transcoding (1 -> 1, 1-> N), enable dual storage, and add code validation

- Change Management: Explain dual-code phase VS final switch and update KYC controls

- GO-LIVE: Transition fully to Rev.2.1 with aligned systems and governance

With the right roadmap and expert support, your Rev. 2.1 transition will be smooth and manageable. Capco has already supported major European banks through this transition, leveraging our deep regulatory expertise and proven frameworks. From code mapping to implementation and regulatory testing, we help streamline the process, minimize operational disruptions, and ensure all regulatory deadlines are met.

Connect with our experts to assess your readiness and start your NACE Rev. 2.1 journey today.