On 22 November 2025, the SWIFT-defined coexistence window for MT (standard SWIFT financial message types) and new ISO 20022 messages closes. The industry is still discussing this date as a technical cut-over. In reality, it marks the start of a structural transformation that goes far beyond format migration, and banks that stop at format migration in 2025 risk facing another major investment cycle in 2028.

ISO 20022 introduces semantic interoperability across the entire financial ecosystem and turns payments from a process-driven back-office topic into a data-powered competitive factor. Recent SWIFT dialogues show that the post-2025 era will be shaped by AI-driven routing logic, wallet-to-wallet integration, a tightened G20 Phase-2 agenda and a brand-new cross-border instant payment scheme.

Starting point: context loss under the MT standard

SWIFT MT messages carry payment instructions but offer no standardized view of the underlying intent. The receiver learns what is paid, not why. This semantic gap forces manual repair, drives up reconciliation cost and limits automation in FX, trade-finance and treasury systems.

ISO 20022: from data standard to semantic interoperability

ISO 20022 embeds contextual metadata—purpose codes, invoice data, shipping details—in machine-readable fields. The result is a common semantic layer that allows systems to interpret transactions in the same way, shifting integration work from point-to-point reformatting to a one-off end-to-end data-model consolidation.

Immediate process impact across the bank technology stack

Using the richer data fields delivers instant process gains:

- FX desks: automatic matching of cross-currency eliminates breaks and manual intervention.

- Trade platforms: letters of credit, shipping and payment data are aligned in a single thread.

- Treasury: forecasting models use transaction intent, not only cash-flow time series.

- Risk & compliance: sharper rule sets shrink false positives and shorten cycle times.

Horizontal and vertical penetration after go-live

Once the coexistence window closes, ISO 20022 will move beyond classic payments:

- FX & treasury engines will consume structured data for dynamic hedging algorithms.

- Cross-border clearing hubs will require native ISO processing for end-to-end transparency.

- Analytics engines will shift from value- and volume-based to intent-based insights.

The resulting ‘data layer’ will act horizontally across all payment rails and vertically through application silos, creating a single integration logic.

AI-powered ‘multilateral schemes’ and multi-operability by design

Recent SWIFT discussions at SIBOS 2025 made it clear that rail convergence is not enough. AI models will soon decide which rail (SWIFT, domestic RTGS, wallet networks, card schemes) is optimal for a given transaction, i.e. introducing multilateral schemes for the same payment rail. Banks must therefore add AI layers that weigh real-time information (cost, speed, FX spread, capital charge) to pick the best path set for every single payment. In parallel, wallet-to-wallet ecosystems are emerging that natively bridge card schemes, SWIFT and regional real-time networks—a trend already live in Asia (e.g. PayNow-Thailand/Grab) and now being exported to Europe and the Americas.

G20 roadmap: Phase 2 tightens KPIs

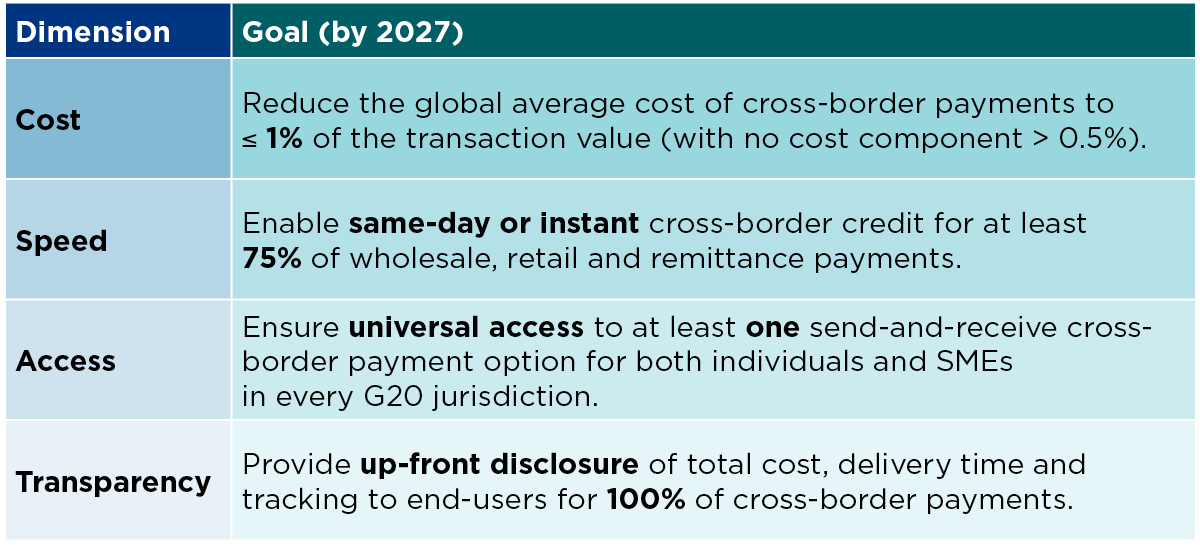

The G20 cross-border payments program targeted by 2027 sets quantitative global goals to be achieved across four key dimensions:

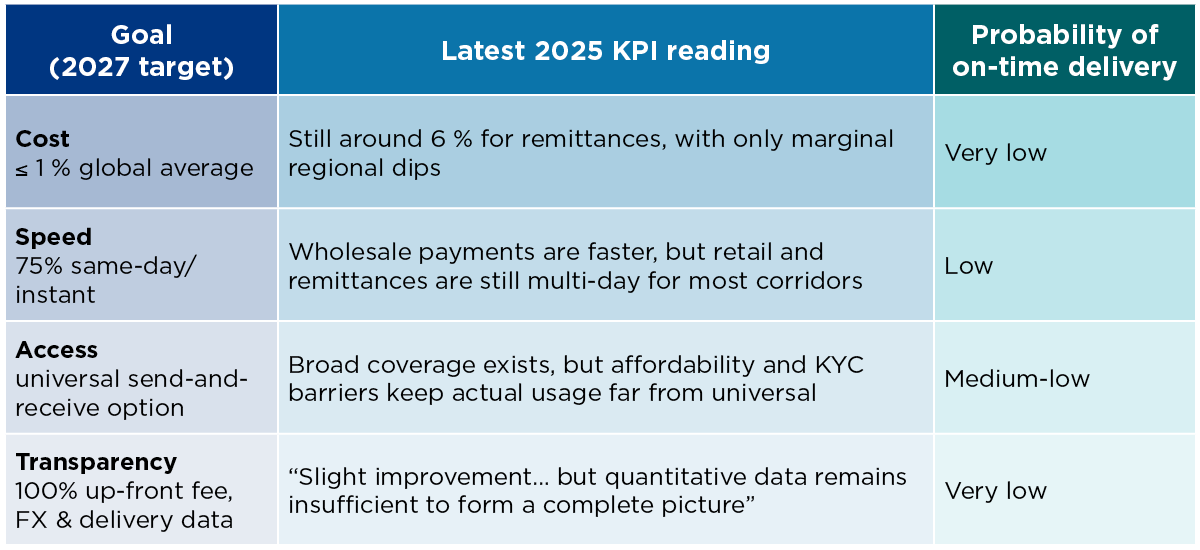

The FSB ‘consolidated progress report’ published in October 2025 makes it clear that none of the four headline 2027 targets are on track to be met on time:

The consequence is Phase 2 starting in 2028 with stricter KPIs and regulatory ‘stick-and-carrot’ mechanics. Banks that stop at ‘format migration’ in 2025 risk facing another major investment cycle in 2028. Institutions that build ISO 20022 data-first today can treat Phase 2 demands (API message exchange, pre-validation, FX transparency reporting) as configuration work, not new development.

SWIFT cross-border instant payments: the next operating system

Additionally, for 2026, SWIFT announced a global cross-border instant-payment scheme built on ISO 20022 messages, pre-validation services and a 24/7 liquidity layer. Participation requires banks to keep not only message formats but also operations and liquidity processes fully interoperable around the clock. Institutions already using ISO data for real-time liquidity steering and API hubs gain shorter time-to-market and lower complexity costs.

Strategic option: consolidation instead of migration

Leading banks use the mandatory conversion to ISO 20022 as a catalyst for rail-agnostic consolidation. Instead of maintaining parallel systems (Fedwire, CHIPS, SWIFT, RTP) they build a single, API-first platform that natively understands every message type, including wallet and card schemes. The payoff is agility: new services, rails or currencies are introduced by configuration, not replacement. Payments become a scalable data service.

Vendor role: continuous compliance and evolution

Technology partners now deliver continuous-delivery models for rule-based validation, AI training data sets, interoperability tests and version upgrades. Banks can launch new ISO 20022-based products, including instant-payment and wallet-interoperability services, without massive re-work.

Conclusion: from format swap to platform economy

The 22 November 2025 deadline is a technical milestone. However, now is the time to treat payment data as a strategic asset. The next stage will be driven by AI-powered routing, integration of wallet and card ecosystems and a tougher G20 Phase 2 agenda.

Banks that treat ISO 20022 as a format exercise will achieve compliance, but not competitiveness. Those that leverage rich data for new products, processes and customer experiences will become part of a single, semantically connected financial fabric, including instant payments and wallet-to-wallet liquidity.

The implication is radical: investing in structured data architectures today is not merely a compliance requirement. It is essential for selecting the optimal channel, which will define costs, efficiency, and the future of cross-border money movement.

HOW CAPCO CAN HELP

Partnering with Capco gives you access to our deep expertise in SWIFT CBPR+ and ISO 20022 payments as well as a proven track record in delivering successful implementation and transformation projects. Our comprehensive offer includes:

- Initial workshop: We start with a workshop aimed at developing a shared understanding of the current ‘as-is’ systems and processes related to payments and associated charges. This helps in identifying areas for improvement and alignment with future goals.

- Onsite workshop with subject matter experts (SMEs): We conduct onsite sessions with key SMEs to thoroughly analyze the impact of transitioning to the new ISO 20022 cash account reporting (statement) messages. This collaboration helps leverage the benefits of the transition, ensuring alignment with strategic objectives.

- Feasibility study and impact analysis: Our experts will deliver a feasibility study and impact analysis, resulting in a well-defined roadmap and a suitable Target Operating Model. These tools will provide a solid decision-making foundation for future actions and strategic planning.

- Program and project setup and implementation: We offer a complete setup for programs and projects, guiding clients through the execution phase with precision and expertise to ensure successful implementation of the new standards and processes.

LET’S CRAFT TOGETHER A SUCCESS STORY

Capco is here to help. The transition to the new ISO 20022 business model requires not only expertise in payments and SWIFT CBPR+/ISO 20022, but also a proper analysis and definition of a future-proof business architecture. At Capco, we focus exclusively on financial service providers and understand the challenges of their day-to-day business.

Capco has demonstrated its deep expertise in this area by successfully facilitating six change requests on behalf of a client directly with the ISO 20022 organization.

With over 250 onshore and offshore payments, ISO 20022 and business architect experts, we have already proven our expertise in numerous implementation and transformation projects. We would be happy to provide relevant references on request.