New Capco global insurance survey identifies clear opportunities to enhance consumer education, digital experiences and transparency

A renewed emphasis on financial literacy, digitalizing customer journeys and data-driven hyper-personalization will allow insurers to deliver better customer outcomes, amplify brand awareness and equity, drive increased engagement, and improve retention levels.

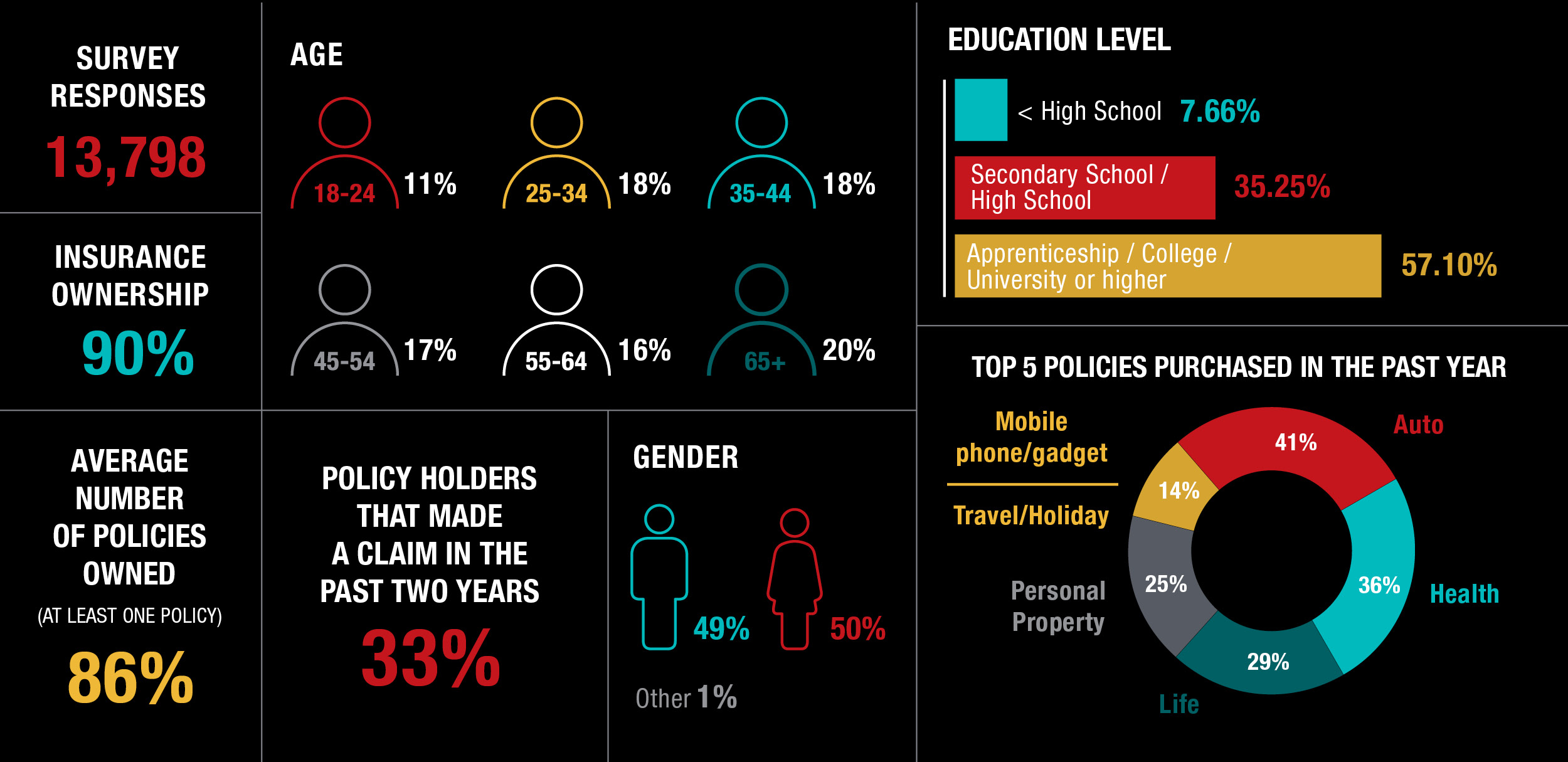

We polled almost 14,000 consumers across 13 markets globally to gauge their impressions of insurance products and providers. The survey provides an overview of public attitudes toward consumer insurance, the key products and services used, and emerging trends.

A number of top-line global themes are identified within the survey:

1. RESPONDENTS ARE STILL EXPERIENCING AGE-OLD CLAIMS ISSUES

- Despite generally high satisfaction with the claims process across the markets surveyed, consumers complain about insurance response times and too much paperwork.

- Technology offers a path forward – three of the top five issues flagged during the claims process touch upon elements that could be supported or enhanced by technology.

2. LACK OF FINANCIAL EDUCATION REMAINS A KEY BARRIER TO ENGAGEMENT

- Four out of ten (37%) consumers surveyed said they do not feel well informed about insurance or available products.

- This uncertainty is particularly pronounced among women (41%), single policy holders (42%), the 18-24 year-old Gen Z demographic (43%) and the uninsured (71%).

- A lack of industry knowledge is the primary reason that people remain uninsured (cited by 28% of uninsured respondents), while a further 25% deem insurance to be ‘unnecessary’.

3. DIGITALIZATION PRESENTS AN OPPORTUNITY TO DELIVER A BETTER ONLINE INSURANCE EXPERIENCE

- Six out of 10 respondents (57%) want a better online experience from their insurer.

- 66% of policy-owning respondents said they would use an app that gave them better visibility into all their financial products (bank accounts, pensions, insurance policies)

4. HYPER-PERSONALIZATION CAN DELIVER BETTER PRODUCTS AND CUSTOMER OUTCOMES

- Nearly three quarters of people would share some form of personal data to get cheaper insurance premiums (72%), whether by using fitness and health tests (33%), home smart devices (32%) and wearable tech such as smartwatches (29%).

- Among young people (18-24s), this willingness rises to 87%.

- However, only 20% of respondents feel comfortable sharing their social media data.

Methodology

The survey was conducted online in April and May 2021 and collected responses from a total of 13,798 individuals. The markets surveyed were the UK, US, Canada, Brazil, Germany, Austria, Switzerland, Belgium, Hong Kong, China, Singapore, Thailand and Malaysia. Country representative quotas were followed. Survey respondents were drawn from six age demographics: 18-24, 25-34, 35-44, 45-54, 55-64, and 65+. 49% of respondents identified as male, 50% identified as female, and 1% identified as other.