UNCLEARED MARGIN RULES BACKGROUND

Global regulators require a complex set of margin requirements for uncleared derivatives. Uncleared Margin Rules (UMR) began phasing in September 2016. In 2017, all firms became compliant with variation margin (VM) requirements. As part of Phases 1-4, approximately 60 of the largest firms are currently in compliance with Initial Margin (IM) rules. Before the effects of COVID-19, more than 200 Phase 5 firms were expected to go live on September 1, 2020.

Since March 2020, market challenges related to COVID-19 have been impacting collateral processing for OTC derivatives. Margin calls for Regulatory IM have increased substantially during the current crisis. Processing volumes have increased by 250 percent in some parts of the market. The intense market volatility and continuous changes to trading practices due to COVID-19 (e.g., DTCC suspension of physical securities processing; following exchange circuit breaker processes; closures of trading floors, etc.) are preventing firms from completing all desired operational activities for a given trading day.

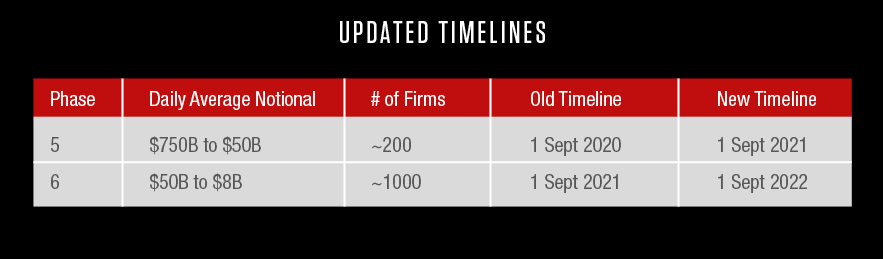

BASEL AND IOSCO ANNOUNCEMENT: UMR PHASES 5 AND 6 DEFERRAL

On April 2, 2020, Basel and IOSCO announced a deferral for the final Phases of the Uncleared Margin Rules. BCBS highlights in a press release the displacement of staff and resources focused on the management of present risks as the rationale behind the delay. The extension will allow firms to focus on the impacts of COVID-19 while providing adequate time to comply with the delayed UMR requirements. Regional regulators are expected to adopt this new timeline soon, and most market participants welcomed the news. As of April 17, 5 regulatory jurisdictions have confirmed the delay MAS(Singapore), OSFI (Canada), JFSA (Japan), FIMA (Switzerland), APRA (Australia) with the US, and Europe expected to confirm the delay shortly.

EXPECTED IMPACT

UMR initiatives at market participants have been impacted by the market volatility related to COVID-19. Phase 5 and 6 firms can take advantage of the 12-month implementation delays.

Key market-wide Impacts of COVID-19 market volatility on UMR

- Further Clearing of OTC Derivatives: The current market volatility has seen firms move more trades to clearing (to reduce counterparty risk arising due to fails within margining process of uncleared trades) and increase the pace of trade compressions. The delay will give more time for firms to move portfolios to clearing and trade compression.

- Reprioritization of Trading, Collateral Operations, and Treasury resources within counterparties: Faced with scarce resources and current market volatility, some Phase 1-4 firms are slowing down the client onboarding activities for their Phase 5-6 counterparts, while some dealers will continue to engage with their Phase 5 and 6 counterparties.

- Adjustment to ISDA SIMM™ risk weight calibration process: ISDA will potentially look at updating the methodology of risk weight calibration to account for market volatility seen in Q1 2020. The quarterly backtesting exercise being currently run (Q1 2020) will incorporate the recent stress period and will be used to recalibrate SIMM at the end of the year.

- Potential change in US Regulatory pre-approval process for Phase 5 and 6 firms to use the Standard Initial Margin Model (SIMM): Regulators may request that firms adjust their pre-approval work to account for more recent portfolio and recent market volatility

Advantages of 12-month delay for Phase 5 & 6 firms

- Potential to scrap tactical approaches: Many Phase 5 firms required tactical approaches (e.g., GRID-only IM calcs, etc.) for an interim period to comply with UMR by the Sept 2020 deadline. Given the 12-month delay, it will be feasible for some firms to move directly to a strategic solution if they keep positive momentum in their UMR programs

- More time to test and validate: For firms ready with their strategic solution, this delay means more time available for industry testing and solves most potential day one issues

- Extended timeline for custodial onboarding: Market volatility and the number of in-scope firms could cause a backlog for custodial onboarding. Firms will be able to benefit from the extended timeline to ensure appropriate setup as long as they continue with their compliance readiness programs in flight.

- Newly in-scope firms can pre-emptively improve monitoring capabilities: Given the delay in the timeline, IM threshold monitoring applications can be implemented during this delay while other preparations are taking place. IM threshold monitoring is important as firms don’t have to post IM or execute documentation until it’s clear that they will actually breach their IM threshold. This will in turn help in reducing funding cost and saving on legal and operational resources

If you would like to share ideas, please reach us at prabhat.singh@capco.com, justin.gonlag@capco.com, mark.demo@acadiasoft.com, and john.pucciarelli@acadiasoft.com

Note: Views on impacts in this document will be updated on a periodic basis due to the evolving nature of this issue.

Contributors: Stephanie Colling and Joann Economou from Capco.