Introduction

Providing meaningful financial advice to retail customers has become a key priority for many financial institutions and insurance companies. Advice in this context is not guiding clients to choose a product, it is helping them understand and plan their long-term financials without necessarily selling a product.

Previously, we published a two-part blog series on this topic. In Part 1 we described the various characteristics of retail digital advice and explored the barriers organizations face. In Part 2, we considered some best practices from industry leaders in this space.

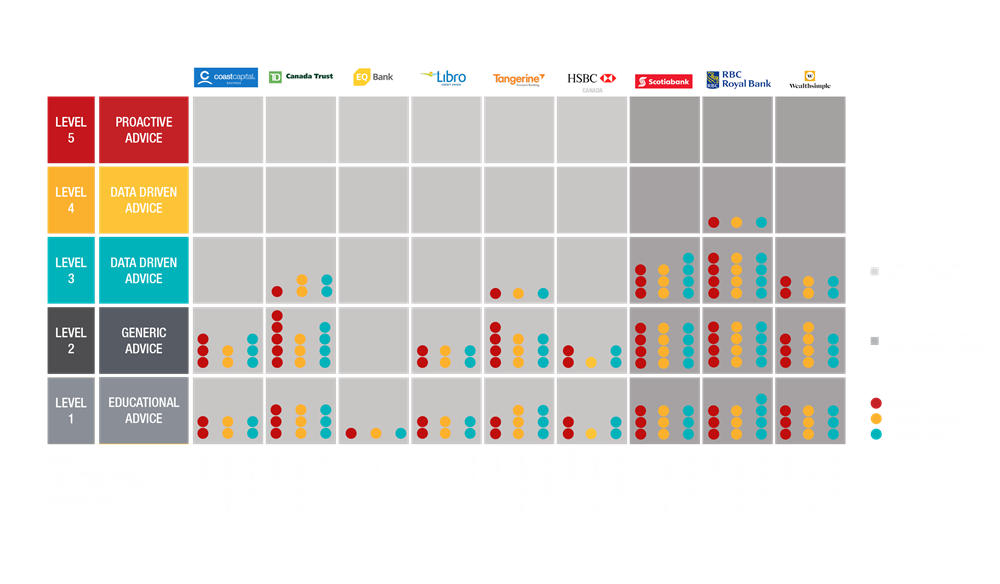

We received a lot of requests for a view of the roadmap that industry leaders have followed to achieve maturity. In this blog, we share a maturity model we created based on a three-year observation of nine Canadian Financial Institutions, and their journey to maturity on Advice. We believe the Canadian experience also applies to other western jurisdictions with similar client needs.

Overview of the maturity roadmap

We observed that institutions that are further ahead on their journey appeared to follow a disciplined approach in standing up key advice capabilities. They started providing financial literacy tools, then they added a more comprehensive generic advice that applies to everyone. Later, they evolved to provide personalized advice based on clients’ specific needs or goals and, lastly, they incorporated a heavy use of data into that advice. RBC and Wealth simple are the clearest examples of this methodic journey and it has taken them more than four years to get to where they are.

Level 2 – Generic Advice

Next came the first real advice offer. Leaders in this space went beyond just enabling simple calculators. They took the opportunity to build on the level 1 capabilities and provide relevant advice to the customer on what the results mean in simple to understand terms.

For example, Scotiabank offers a wide variety of calculators that are easy to use while providing the context in how the results fit into the financial topic the customer is learning about.

Level 3 – Personalized Advice

On this level, we saw the biggest leap toward a real non-product-focused conversation as digital and in-person advice intersects. RBC, Scotia, CIBC, and TD have successfully captured clients’ information via self serve digitally with tools, such as “financial health check.” The actual advice conversation is done with an advisor. But this is where some institutions hit a wall, as none has been able to get meaningful uptake with self serve “conversations,” and scaling using existing branch processes is not financially viable. Virtual in-person advice sessions seem to be the answer that Wealth Simple and RBC have found to achieve scale at this level.

Level 4 – Data Driven Advice

We are beginning to see banks building their level 4 capabilities, but it is in the early stages. On this level, institutions manage to consolidate their client’s data and use it to provide advice beyond what an advisor could give. Comparing client’s financial plan to that of their cohorts or comparable individuals “people like you” or running what if scenarios that show them possible future consequences of current decisions.

Level 5 – Proactive Advice

Level 5 remains an elusive level! However, at this level, institutions can truly transform their relationship with their retail customers. The capabilities at this level allow banks to leverage real-time data collection, analysis, and customer insights to provide continuous and even perhaps subscription-based advice driven by data and personalized to customer needs. This resembles investment advice for mass affluent clients but catered for retail customers for their financial planning.

Analysis of several Canadian Financial Institutions

We plotted the results of our analysis against the maturity levels. The analysis was based on a firsthand attempt of seeking financial advice through the available bank avenues like self-help tools and meetings with advice agents. We discovered some interesting insights.

There is no level 3 without level 1

The banks which are doing well at providing personalized advice did educational advice well too. If you are not able to win the customers’ trust when they are looking for general advice, its unlikely the customer will trust you to provide them with advice which is unique to their situation. Given customer journeys are non-linear, this becomes especially important.

You do not always need to achieve full maturity at each level to go to the next one

Wealthsimple is a good example of this. It focuses on select capabilities at each level and does them well. As a result, it can serve its selected target segment based on its market vision. It does not need to add the full plethora of self serve tools and product offerings like a traditional bank.

To learn more about Capco’s Retail Digital Advice solutions, contact solutions@capco.com

Blog partly based on a study by Hisham Sadiyyah, Abigail Wilson, Radhika Avhad, and Tayabur Rahman