In this two-part blog series, we will explore the world of retail advice in banking. In this first piece, we examine why so many institutions are struggling to scale retail advice, and in the second, we will share five best practices from leaders in this space.

For more than a hundred years, banks and other financial institutions have offered advisory services to high-net-worth clients. In the early 2000s, wealth-technology start-ups reshaped the advisory landscape by offering robo-advisory services to the mass affluent segment. In the last five years, advisory services have again entered a new frontier: advice for the retail segment. The retail segment consists of customers with less than $100,000 of investable assets.

With 78 percent of all retail clients expecting advice, this topic has captured banking executives' attention.

What is Retail Advice?

Retail advice is very different from mass affluent advice; it is broader, more difficult to deliver, and, at times, less profitable. Retail advice consists of three main characteristics:

Broad in scope: retail advice starts with basic how-to education and product selection recommendations. It moves to personal financial management (PFM) services, like cash flow management, and includes life-events and scenario-based retirement planning.

Multiple delivery methods: banks typically offer pieces of retail advice via self-serve channels, in-person at the branch, or through a hybrid model using virtual meetings. However, institutions cannot choose just one channel; they must support them all to ensure scalability.

Education first: value from retail advice is derived by educating clients to be financially literate and by influencing behavior changes. Trust is a crucial part of the process. Clients will not change their behavior because of a recommendation from someone they do not trust. For this reason, selling while advising is discouraged, and handholding is often expected.

Banks have been offering advice tools for retail clients for years. Primarily product selectors and cashflow tools, have only looked at them as part of the big advice offer.

Why Do Banks Struggle to Scale Retail Advice?

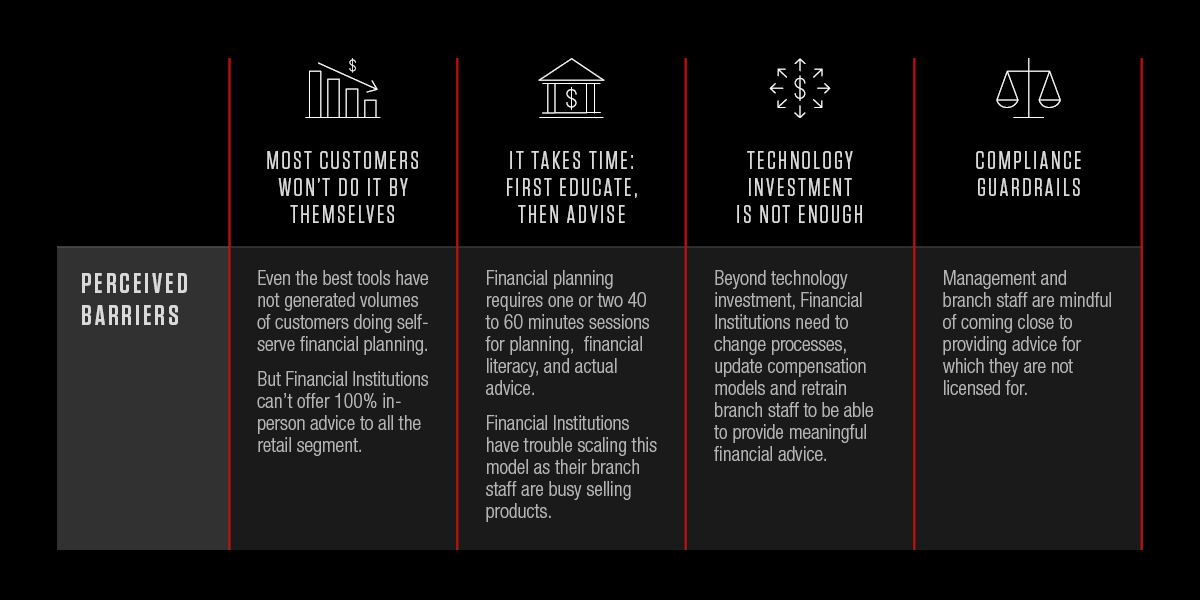

Early entrants in the space did what seemed natural: they took the tools that mass affluent advisors used, simplified them, converted them to self-serve, published online, and invited clients to self-advise. However, volumes were disappointing, even for platforms that had a good customer experience. Analysis by organizations attempting this approach pointed to a portion of clients that weren’t interested in starting the process because of a lack of perceived value. For customers who did continue using the platforms, overwhelming complexities with scenario planning later led to abandonment. This is the first retail advice barrier: clients will not self-serve advice without step-by-step help and support.

Banks that decided to take an in-person approach to offer retail advice noticed that it took close to two forty-minute sessions to provide simple financial advice, and most of this time was spent on teaching financial literacy rather than on actual advice. This amount of time was difficult to justify for branch executives, given the small per-client revenue generated. The second barrier is that typically, retail advice takes longer to execute than most banks are willing to invest. Banks needed to find a way to scale profitably.

Institutions that conducted branch-level pilot testing of retail advice services encountered another hurdle with scaling. Branch staff whose compensation packages were heavily based around commission were now spending a large part of their day offering retail advice, during which the selling of products was prohibited. In addition, client satisfaction with financial planning sessions conducted by non-licensed advisors was significantly lower than their satisfaction after a session with a trained advisor. Banks have had to significantly invest in retraining exercises to ensure that customers are receiving qualified advice as well as a good customer experience. In short, having the right tools for advisors and clients was not enough.

Finally, bankers found that advice was a holistic conversation, where they were previously used to narrow, product-specific meetings. Compliance departments, branch managers, and front-line staff were worried about providing advice on products they were not trained or licensed for. A new set of service guidelines are required to provide holistic advice while following regulations to combat this uncertainty.

Retail advice has proven difficult to scale within the existing banking operating model. It requires a top-of-the-house commitment, process changes, technical investment, and a mentality shift.

However, there are clear examples of banks that have managed to launch and scale a retail advice offer successfully. Our next blog will explore the best practices of institutions currently considered market leaders in this new frontier of customer retail advice.

To learn more about Capco’s retail advice solution, please contact solutions@capco.com.