With governments and citizen activists demanding advancements in sustainable business, ESG initiatives are moving to the forefront of today’s market economy. In this environment, it is crucial for financial institutions to effectively manage ESG-related risks and capture ESG-centric opportunities as we see numerous examples in various domains of the Financial Services and Insurance industry.

Company top executives and directors are carefully looking at environmental and social issues as an opportunity to increase market valuations and facilitate growth. Consumers increasingly favor companies which are investing to help the environment and society as this could be beneficial for business. Investors see above-market returns by those incorporating ESG factors in their portfolios. Management teams are prioritizing the ESG agenda in capital markets by giving sustainability a leading role in establishing corporate structures, striking M&A deals, or raising funds through initial public offerings or bond issuances.

Capital allocators are backing companies that can demonstrate the ability to address and protect against the world’s top sustainability issues such as public health crises, inequality, and climate change, which represent significant business liabilities. Similarly in the bond markets, investors are incorporating ESG risks into their credit analysis, while companies are demonstrating increasing appetite for green, social and sustainability bonds, which issuers use to fund environmental and social projects.1

Sustainability-conscious companies are pursuing ESG in corporate governance through structures such as Public Benefit Corporations or B-Corps. This designation is not new, but it can be beneficial as it acts as a kind of certification for companies whose founding principles are already based on sustainability. Vital Farms, an ethical food producer of pasture-raised eggs and butter, is a recent example of a B-Corp that sparked investor interest.

ESG factors are also affecting management team responses to shareholder activism and formulations for executive compensation. Employees are showing bigger interest in working for sustainable companies, whose regulators are enforcing policies that incentivize ESG improvements. Top executives nowadays consider ESG opportunities in capital markets as wide-ranging and interconnected, understanding well that the ESG impact on valuation and performance is both a material risk and a growth opportunity.

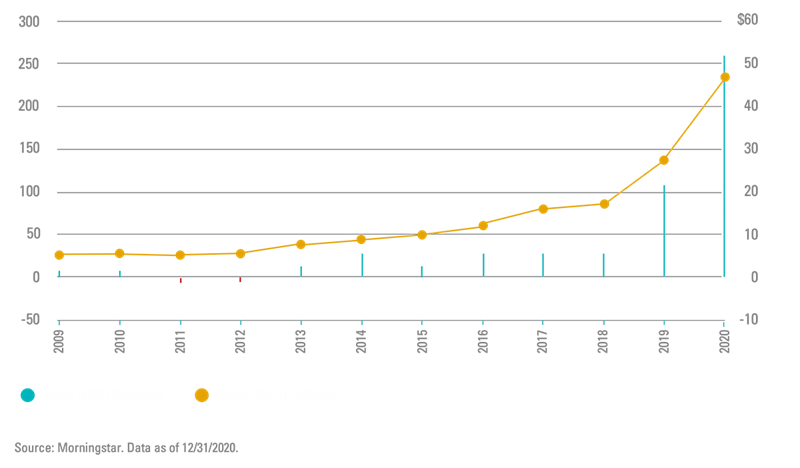

Flows into the United States’ sustainable and open-end funds and exchange traded funds (ETFs) reached almost $50 billion in 2020 alone, which represents over 10 times increase from 2018 according to the research from Morningstar from January 2021 – A broken Record: Flows for U.S. Sustainable Funds Again Reached New Heights.

Sustainable Funds flow in US over the last decade:

The significance associated with ESG considerations has sky-rocketed over the last decade and will likely continue to rise and influence how investment managers and asset owners evaluate all aspects of their investment life cycle.2 Detailed research has proven that securities lending is and ESG are compatible and not mutually, however due to the infancy of the process, it was acknowledged that there are opportunities to improve the security lending programs primarily in their focus to be evaluated against ESG considerations.

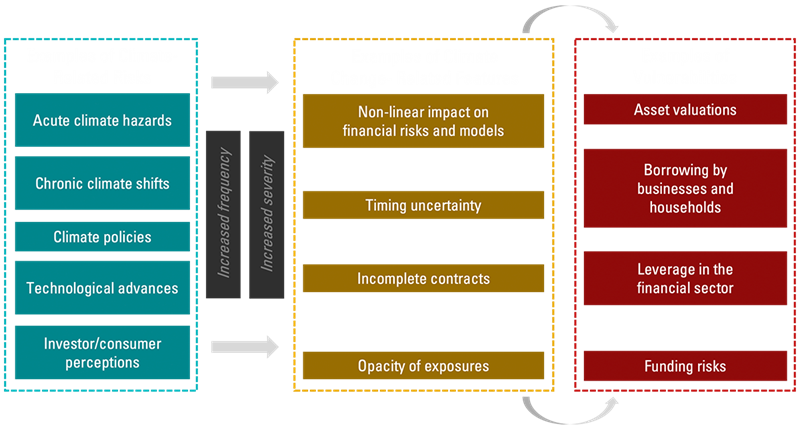

Securities and Exchange Commission (SEC) and Federal Reserve play a crucial role in setting the U.S. ESG agenda by establishing and assessing ESG metrics for the institutions that they oversee. This is especially true for climate related changes, driving financial stability risks which can emerge as either shocks or vulnerabilities into their framework, represented on the financial stability reports.3

Possible Transmission from Climate-related Risks to Financial System Vulnerabilities:

Consistent with increasing investor focus and reliance on climate and ESG-related disclosures and investments, SEC4 stepped in to create a Climate and ESG Task Force in the Division of Enforcement in 2021 with primary focus to proactively identify ESG-related misconduct. It will bring together a broad array of experience and expertise which will allow SEC to better police the market, pursue misconduct and protect investors.

Conclusion

As investors and regulatory bodies become more attuned to ESG concerns, the financial services industry is now seeing capital allocated based on ESG information and ratings. ESG is becoming the “industry standard” as consumers gravitate towards brands that address ESG issues in ways that align with their own values. As ESG reporting continues to evolve, firms that innovate more quickly will race ahead.

Recommendations for financial organizations to advance the ESG agenda and stay ahead of the competition:

- Ensure the firm is prepared to manage all aspects of the ESG challenge and has a strategic approach to Green, Social and Sustainability to promote ESG benefits to their investors

- Align to an ESG ratings provider or an ESG data aggregator organization so that the company’s ESG performance can be measured and tracked relative to other firms

- Consider the attributes of ESG data, which are hard to track and still evolving, in your company's data management standards and methods, especially when supplemented by third party data

- Create transparency for improved ESG data management; encourage the better use of ESG global data assets for sustainability which in turn will lead to better financial and societal outcomes

- Create education programs to inform their stakeholders internally and externally about ESG and how it is going to impact “Business as Usual”

___________________________________