22 January 2021

BUY NOW PAY LATER: THE STORY SO FAR

Buy Now Pay Later (BNPL) is transforming the way consumers shop, spend money, and think about credit. In this blog, we provide an overview of this growing market.

Buy Now Pay Later (BNPL) is a new point-of-sale personal finance proposition that has gained huge traction with UK customers - allowing them to take a product and delay or stagger the payment.

Despite its success, the transparency of BNPL payment terms have been called into question. Its enhanced regulatory focus, coupled with growing BNPL usage, has shown that BNPL is no fad in the world of consumer credit, it's here to stay.

As entrants continue to disrupt financial services, we have investigated:

METHODOLOGY

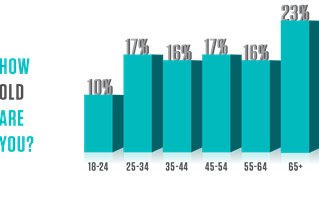

During September and October 2020, Capco conducted a survey on the rise of Buy Now Pay Later (BNPL) personal finance offerings. We set out to understand BNPL usage and where it fits in the wider consumer credit industry, as well as key trends for consumer spending habits and differing levels of financial education.

The survey was conducted in conjunction with Brandwatch Qriously, a market research and polling company that offers an online service to measure location-based public sentiments in real-time. We collected responses from 2,016 individuals; all were UK-based, with the majority located in and around England’s major cities, including London, Manchester, and Birmingham.