Back in 2018, the Financial Conduct Authority investigated the efficacy of the home and motor insurance markets and how those markets serve consumers. Upon investigation, the FCA discovered that whilst customers may shop around for deals, existing and loyal customers were not getting good value. They went on to find that six million policy holders in 2018 could have saved £1.2 billion collectively had they paid the average for their risk (FCA, 2020).

On average, new motor insurance customers pay £285, while customers who have been loyal with their provider for more than five years pay £370 (FCA, 2020): a deficit for the loyal customer of 30 percent. New home insurance customers can expect to pay £130 for buildings insurance, whilst loyal customers who have been with their provider more than five years pay £238: a deficit for the loyal customer of 83 percent.

A summary consultation was published in September 2020, which has led to the latest policy statement iteration PS21/5. The new rules are expected to come into effect on 1st January 2022. The FCA goes on to estimate that the proposals will save customers £4.2 billion over 10 years (FCA, 2021).

The FCA has announced a number of changes, which are outlined below.

(1) Pricing remedy

The FCA have proposed a new pricing remedy so that firms must offer a renewal price to a customer that is equal to or no greater than the equivalent new business price (ENBP). The ban on price walking will change the insurance drastically.

(2) Product governance

The requirement is ensuring firms focus on delivering fair value to customers, which comes from strong governance and oversight arrangements. New obligations have been added to the Product Intervention and Product Governance Sourcebook (PROD): within PROD 4.5.

(3) Cancelling auto-renewing policies

The FCA have recommended firms ensure a range of accessibility options to opt out of auto renewal within the term of a customer's policy. Proposals that were recommended include:

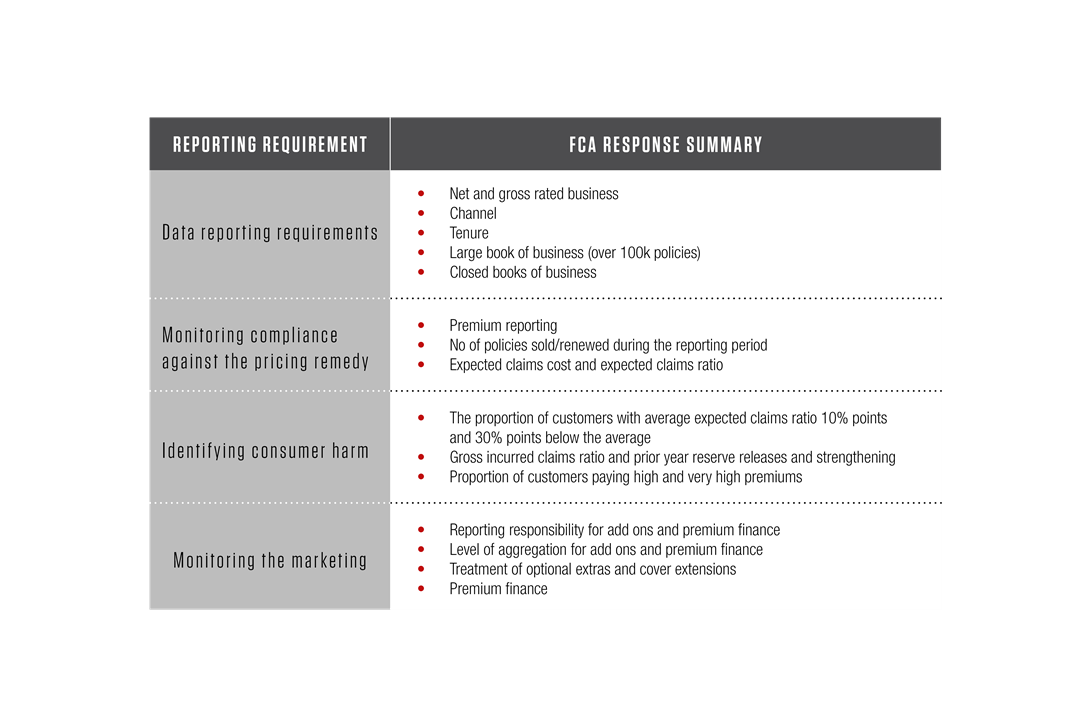

(4) Reporting requirements

The FCA have recommended a requirement for firms to meet reporting requirements on information about their home and motor insurance businesses. The purpose of the reporting requirements is to help with the following subjects: