As part of our six-part article series, Transformation in Payments, we explore experiences and best practices from past projects, providing valuable insights for banks and payment service providers undertaking payment transformation initiatives. This article focuses on selecting the most effective migration approach.

When undertaking a payments migration, the question of the ‘right’ migration approach arises—whether implementing a new payment system or migrating to an existing one, such as in a post-merger integration. In this article, we explain the various ways to structure a payment transformation project and the key factors to consider when selecting the most suitable migration approach for a successful implementation.

Understanding different migration approaches

Designing a payments migration strategy offers numerous possibilities and varies in complexity depending on the scope and depth of a bank’s payment business.

- Navigating business and process complexity

At the outset of any payment changes project, it is crucial to develop a comprehensive internal understanding of the interdependencies between payment processes across different payment types. Based on this understanding, key requirements for the selected migration approach—such as setting up temporary interfaces—can be identified. This enables the creation of a shortlist of feasible migration approaches for further decision-making.

- Balancing different interests

Beyond business and process evaluations, a major challenge lies in aligning the interests of various stakeholders—each bringing their own perspective on the change project.

From a sales perspective, the priority is often to select a migration approach that minimizes disruption and communication efforts— typically favoring a ‘big bang’ strategy, where all changes occur simultaneously.

However, production teams usually prefer a controlled, phased approach due to the cut-over risks associated with a ‘big bang’ strategy, such as processing issues caused by high transaction volumes or increased customer inquiries.

Managing these conflicting priorities within the organization is one of the key challenges in selecting the appropriate migration strategy.

A decision-making framework

To address these challenges, a two-step approach has proven effective in practice:

1. Analyzing key payment aspects to create a shortlist

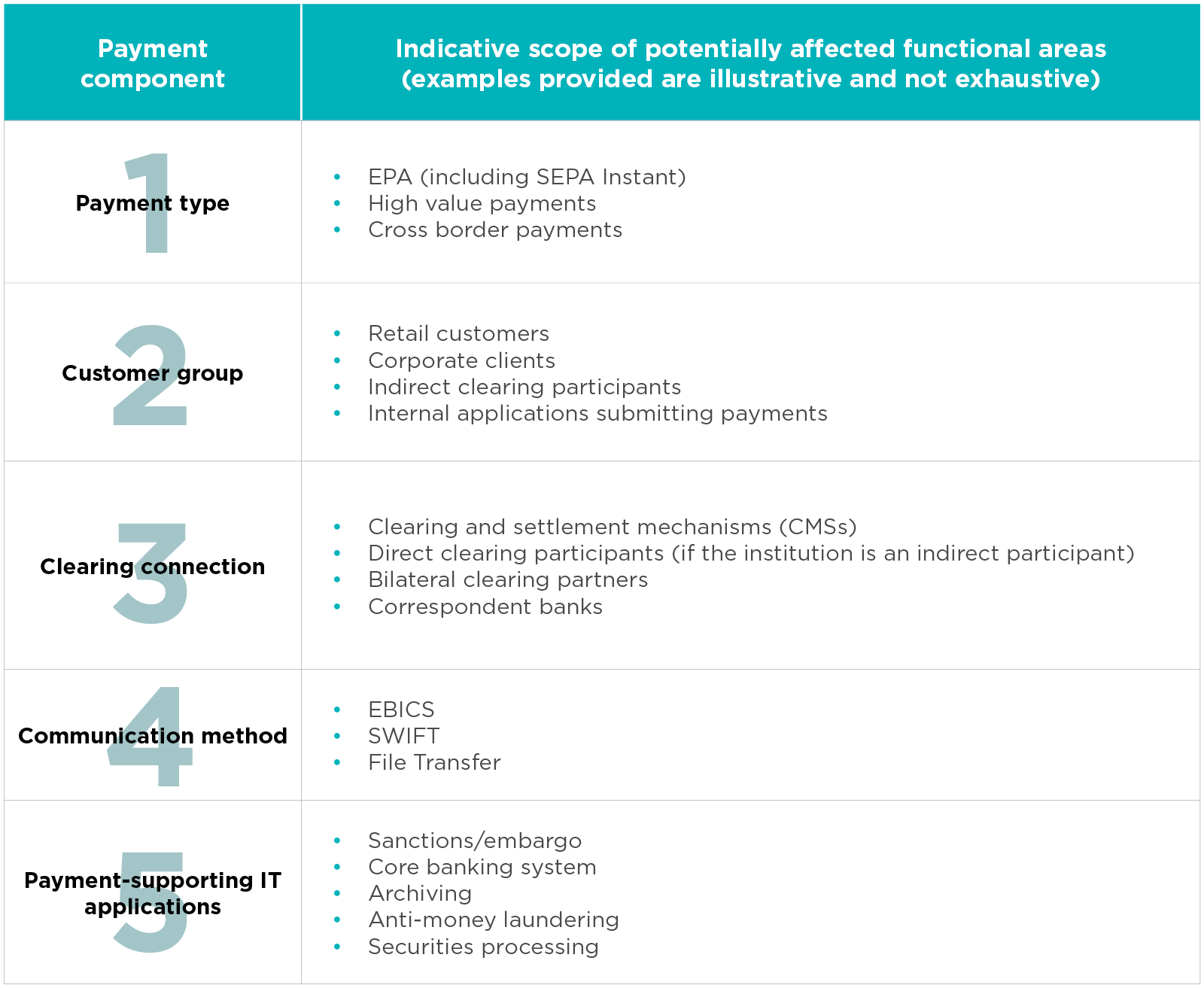

To effectively narrow down migration options, it is essential to determine the scope of the affected payment components. The table below outlines key areas to consider when defining the project scope.

Following this analysis, recommendations and constraints can be derived. For instance, if multiple payment types and customer groups are affected, the resulting complexity may favor a phased migration approach. Conversely, restrictions in technical communication—particularly in the transaction direction market-to-bank—may support a big bang approach. Based on these insights, a shortlist of feasible migration approaches can be developed as a foundation for further decision-making.

2. Structured decision process to select the migration approach

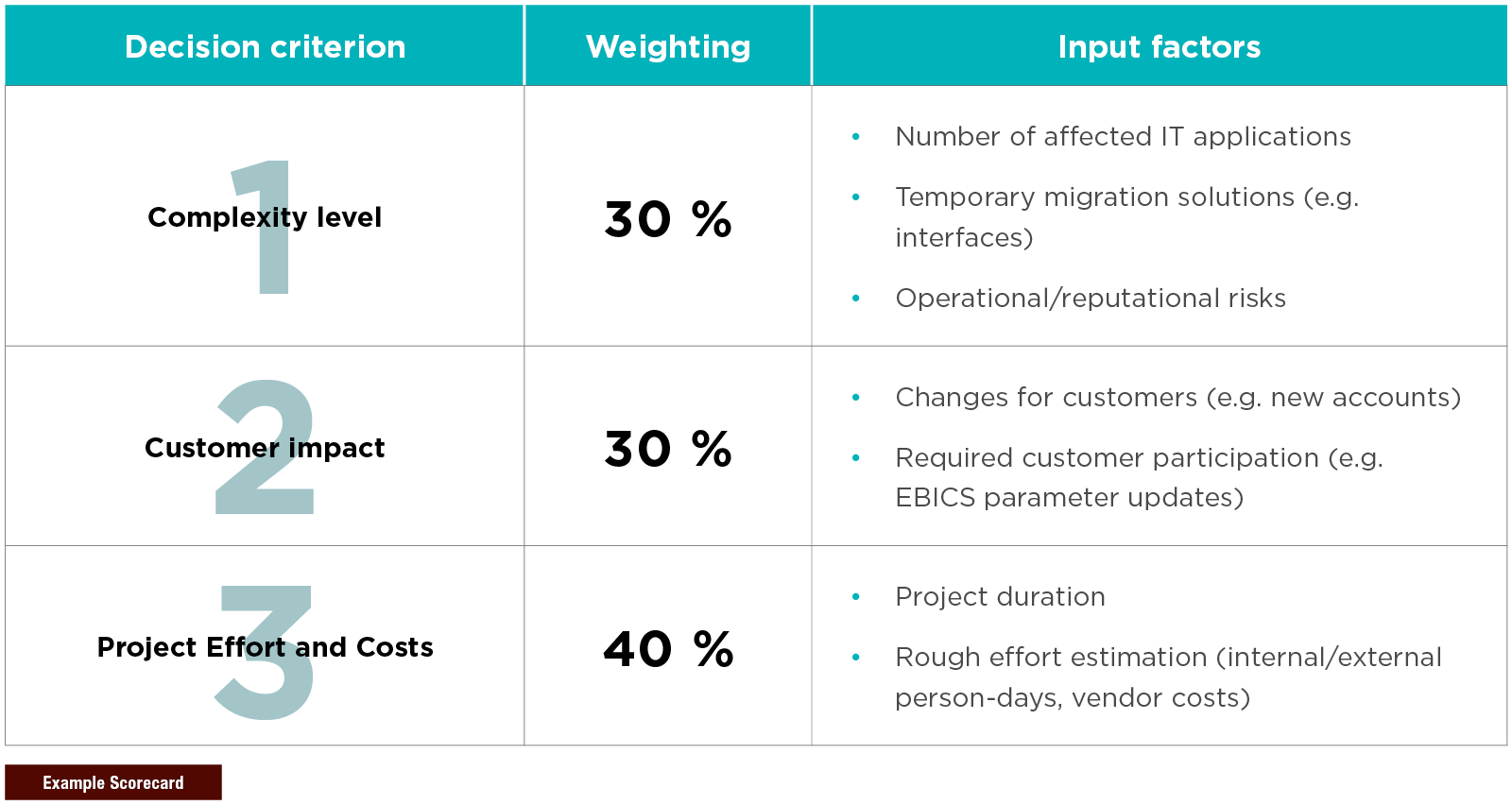

Once a shortlist of realistic approaches has been compiled, the next step is to make a structured decision regarding the migration approach. A recommended practice is to evaluate each option using predefined decision criteria in a scorecard format.

Example Scorecard

By using predefined criteria, available migration options can be compared transparently and systematically.

To ensure broad acceptance of the analysis as a foundation for decision-making, it is crucial to involve all relevant stakeholders early in the process—particularly when defining the scorecard criteria and their respective weightings.

Conclusion

There is no one-size-fits-all blueprint for payments migrations. The most suitable migration approach depends on the project’s nature and scope, and the stakeholders involved. Conducting a preliminary analysis to define the project scope helps narrow down the wide range of migration options to realistic alternatives. A structured decision-making process ensures comparability between approaches and encourages early stakeholder engagement – resulting in a well-informed, supported migration strategy.

Capco has extensive experience in designing effective migration strategies for a range of payment transformation initiatives. In addition to offering subject-matter expertise, we also support organizations in setting up and executing structured decision-making processes.

Back to main page

The payments landscape is undergoing profound changes – driven by emerging technologies, evolving regulations, and shifting market dynamics. Capco supports you with practical, experience-based strategies – from conceptual studies to go-live management. Discover how to execute your payments transformation with lasting success.

Contact Us

Our six-part article series provides actionable insights and proven strategies to help financial institutions navigate the complexities of payments transformation—from modernizing infrastructure to meeting evolving regulatory demands.

If your organization is exploring similar initiatives or facing transformation challenges, we’d be glad to support you.

Contact us to learn how we can help drive your success.