Building upon the success of Benchmarking Mobile Banking in Switzerland Today, Capco Digital is following up with several deep-dive blogs on selected topics from the survey.

The advent of mobile phones has ushered in the era of notifications – banners, pop-ups, pings and red badges constantly vie for users’ attention. This meant user behavior has evolved, too, with users wanting to manage which apps, services and companies may interrupt daily life with a notification. Meanwhile, operating systems are getting stricter with permissions and ever-granular settings for notifications, allowing for finer control but adding complexity for both users and app developers. For banking, this presents a real opportunity.

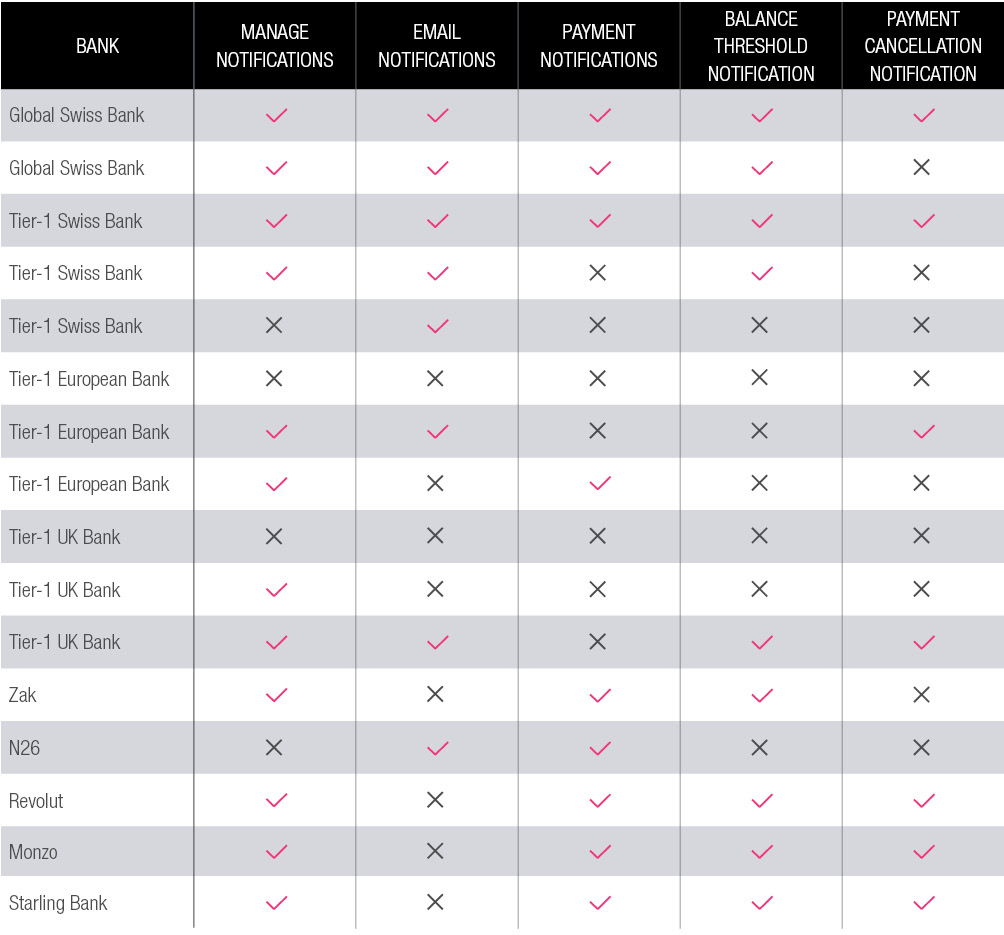

FUNCTIONALITIES OF A NOTIFICATION SCHEME

Personal finance is a topic on which users generally like to be notified of in real-time, to feel secure, in control and well informed of their behavior. Thus far, banks have insufficiently leveraged this opportunity for various reasons:

- Notifications are frequently ignored as part of the technical architecture, which often results in after-thefact vendor purchases to remedy the situation and push out notifications at a bare minimum

- Keeping notification settings synced across multiple channels (e-mail, online banking, SMS text messaging) can get complicated. Banks pay a lot of attention to consistent and compliant cross-channel experiences. Best practice suggests that insecure channels such as e-mail and SMS should be abandoned in the medium term. Moreover, from a cost perspective, banks are incentivized to migrate users away from SMS to push channel notifications.

- Legacy infrastructure often doesn’t allow for real-time streams of events. Core banking systems often book transactions once a day. Even if message streams are available, these need to be exposed and connected through to the front channel systems.

- Banks mistakenly think notifications are about marketing. They’re not. Notifications are to notify users. We have observed multiple scenarios where notification schemes are primarily treated as opportunities to up- and cross-sell rather than to inform and educate the user about financial activities.

As a standard, best-practice notifications scheme, we recommend the following functionalities:

- Payment notifications: Inform users when a payment was executed successfully (or not). Consistency is key - notify the user at every event. Users in interviews indicate that they like getting a notification shortly after swiping their debit card in a store, even if this seems redundant.

- Balance notifications: Inform users when an account balance falls below a certain threshold - possibly set by the user. This is usually a warning that users will use to either slow down their spending to prevent a negative balance or to top up their account. Both actions can be offered to users as part of the notification.

- Manage notifications: Provide users the ability to customize notification types, frequency and privacy levels in an easy-to-understand manner (e.g. if users want a notification but do not want it to contain payee information). Other events, such as personal finance management related notifications or reminders for recurring payments, e-bills and others may be considered based on the bank’s specific product portfolio.

BENCHMARKING MOBILE BANKING IN SWITZERLAND TODAY STUDY

Reviewing 16 traditional and challenger banks across Europe and Switzerland, we see that notifications are generally a weaker feature among incumbent banks, and challenger banks are leading the way. This is likely due to constraints of legacy systems, resulting in messaging streams being tapped for notifications.

OUR RECOMMENDATION

Based on our study, we can conclude that Swiss banks are outshining other European banks for their coverage of notification features. It is also evident that the leading challenger banks tend to focus more on payment and balance notifications using the push notification channel instead of e-mail and SMS channels. For Swiss banks to strengthen their position in the notifications space, we recommend enlarging proactive push notifications about balance changes and anticipated situations in line with an improved user experience, to offer contextual insights into a customer’s financial activity feed.

CONTACT

Nils Reimelt, Managing Principal

M +41 79 135 85 22

E nils.reimelt@capco.com