The Banking as a Service (BaaS) model is becoming a permanent feature in a customer-centric world. With neobanks and fintechs racing ahead in its adoption, how can incumbent banks capitalise on their space in this market?

A customer-tailored, on-demand service that has evolved as a key component of the open-banking framework, Banking as a Service allows consumers to access a full suite of financial services from current accounts and loans, to credit cards and mortgages through API platforms and cloud-based systems.

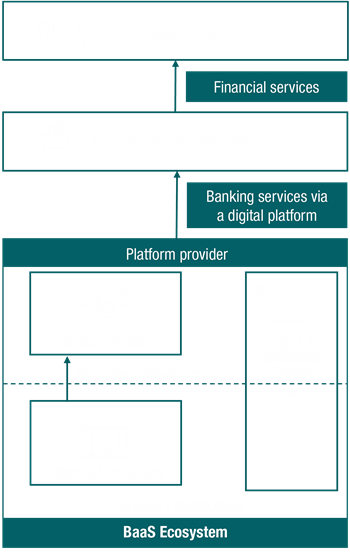

The BaaS model brings together non-financial retailers (e.g. Uber), financial institutions and/or other service providers (e.g. Solaris). Customers interact with a retailer that is offering banking services through the BaaS ecosystem via the combination of a provider’s platform and a licenced bank’s secure and regulated infrastructure (a in the diagram below). In short, there is no need for the customer to interact directly with a bank and/or other financial providers, as through the BaaS model they can access banking products and services directly through their favourite brands (1) (2) (3)

Digital banks, such as Treezor and Solarisbank, can act both as the licence holding financial institution and the service provider offering white-label banking capabilities to retailers (b in the above diagram) (4) (5). Such banks, acting as pure BaaS providers, recognize there is a huge opportunity for revenue growth waiting to be tapped and to gain an advantage over their competitors.

A Bloomberg report last year estimated that BaaS revenues will reach $12.2 billion by 2031 (6), while Insider Intelligence predicts that figure will hit $2 billion in the UK alone by 2024 (7).

The advent of open banking supported by technological advancements, regulatory changes including the Revised Payment Services Directive (PSD2) and changing consumer behaviours amplified during the pandemic have combined to make BaaS an increasingly attractive option (3).

In the world of digital commerce, the customer experience is carefully optimised at every touchpoint. However, this involves more than just selling banking products online. The BaaS platform allows providers to offer a service that rapidly answers the needs of the modern-day consumer by focusing on separate key aspects:

The consumer experience – and the personalization of that experience – is central to the appeal of BaaS. Following the rise of fintechs and open banking in the post-COVID world, incumbent banks are focusing on investments in cloud-native, scalable technologies and marketing strategies to retain and attract customers. Today’s consumer has increased expectations from their financial institutions, with rising demand for more personalised financial services, such as banking advice based on their personal circumstances and real-time, predictive banking offers delivered at their point of need.

Who are some of the major players in Banking-as-a-Service?

Incumbent banks such as J.P. Morgan, BBVA and Goldman Sachs and neobanks including Starling Bank, SolarisBank and ClearBank are using the BaaS platform and playing the dual roles of financial institution and service provider through in-house cloud native API ecosystems that allow them to offer services such as loans, payments and digital banking.

At the same time, Tech players are expanding into the fintech space and have started offering financial products – Apple, for instance, through its partnerships with Goldman Sachs in the US and Barclays in the UK and Xero through its strategic partnerships with Starling Bank.

Likewise, on the retailer side, Uber is offering a Visa card through Barclays US that allows their customers to make payments and transfer balances, while Vodeno has partnered up with Aion Bank to offer a whole suite of embedded finance services.

While there are already many players across the ecosystem, its rapid growth means there is plenty of opportunity for other incumbent banks to make their presence felt.

Customer needs are rapidly changing, from expectations of a seamless digital experience across the costumer journey to wanting tailored products reflecting their personal circumstances. BaaS offers banks and other providers the ability to address that challenge through collaboration that delivers enhanced and more specialised services. However, this can only be achieved through:

We live in a transformative age where speed can bring plenty of opportunities to those willing to adapt. Especially those players that wish to capitalise on the high demand for embedded financial services, allowing them to experience business agility and sustainable growth. However, this will require incumbent banks to go through a transformational journey, to adopt new business models and transform their core architectures to cater for scalable growth or build new banking entities that are unencumbered by legacy systems and processes.

1 https://services.google.com/fh/files/misc/apigee_embedded_finance_gold_rush_paper.pdf

2 https://www.finextra.com/blogposting/20099/what-the-hell-is-banking-as-a-service-and-what-is-it-not

3 https://medium.com/fintechtris/fintech-focus-what-is-banking-as-a-service-baas-2627e9a73377

4 https://www.businessinsider.com/private-white-label-banking?r=US&IR=T

5 https://www.treezor.com/en/white-label-money-pot/

7 https://www.insiderintelligence.com/insights/banking-as-a-service-industry/

8 https://www.temenos.com/wp-content/uploads/2021/09/Open-Banking-and-BaaS.pdf

9 https://medium.com/the-regtech-hub/banking-as-a-service-a-new-model-for-revenue-growth-8df7021a9044