The way that pensions are administered in Hong Kong is changing. A new single, centralized platform will soon make it simpler, quicker, and smarter for employees to manage their provident fund accounts and for Trustees and employers to administer pension portfolios, upload contribution data and manage pension investments through a single interface. The goal is to say ‘goodbye’ to filling in paper forms and manual processes and ‘hello’ to streamlined and standardized pension administration and pension-related tasks.

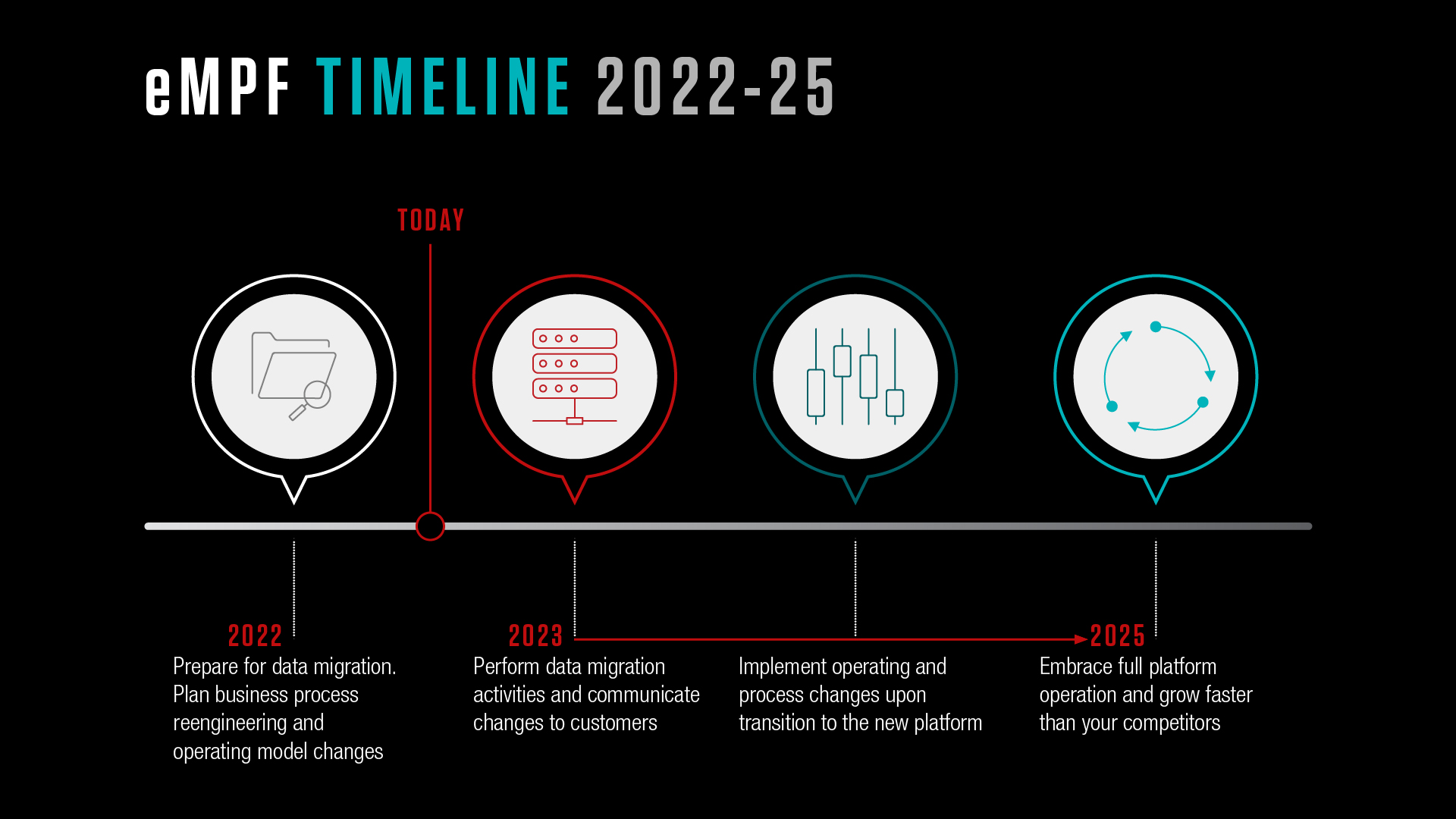

The eMPF project, which Hong Kong’s Mandatory Provident Fund Schemes Authority (MPFA) has commissioned through PCCW Solutions Limited, will digitalize and automate the way the MPF system is administered between now and 2025. The change aims to reduce human error and processing costs while improving administrative accuracy and efficiency. However, the transition phase is full of challenges and opportunities in terms of preparing to migrate data to the new platform and identifying new operating and business models that can take advantage of new automated processes and improved access to data to gain a competitive edge.

Countdown to change

The construction of the eMPF Platform started in 2021 and will continue throughout this year. Data migration and a phased transition to the new platform by trustees will begin in batches in 2023 and is expected to take around two years, with the platform planned to come into full operation in 2025.

All market players are therefore about to start a multi-year digital transformation journey, with MPF administrators preparing themselves for a phased transition to the platform starting in 2023. Preparations will include the cleansing and standardization of data, a review of business processes and an assessment of operating structures.

Changes to operating and business models

The transition to eMPF will modernize the time-consuming paper-based operating model across core processes, people and technologies including activities such as enrolment, contributions, and benefit withdrawal. For example, instead of having employees and administration teams manually fill in and process enrolment forms, the eMPF Platform will require trustees to perform the enrolment set-up via the newly built communication portal and use this to provide fund information.

We foresee the entire business model of MPF administrators shifting away from the administration of the MPF paper forms, and towards servicing customers in new customer centric ways. As well as understanding what needs to be done to prepare for the transition, administrators will need to look at their target business model, around which they can design new operating model capabilities. Team structures as they stand today may need to be restructured to ensure the administrators remain competitive and provide the required service whilst remaining cost efficient.

MPF administrators will need to engage in many disciplines to design an appropriate delivery framework for the eMPF adoption. A current state analysis is important to understand the likely pain points in the transition, and to identify where the impact will be greatest and the changes that need to be made. After defining the target state, key functional capabilities, technology components, data flows and interactions – both internal and external – can be assessed and, if required, re-designed. Trustees will also need to understand the impact to members, scheme sponsors and employers so they can educate them and support them on the shift to using the new platform.

Governing and managing data

The new eMPF Platform will have its own unique data model that will need to be understood and mapped to. Data will need to be cleansed – identifying incorrect or irrelevant information – across the pre-migration, migration and post-migration phases.

An effective data migration strategy needs to be clear on what information is to be migrated, put policies and guardrails in place to ensure data is going to the right destination, and ensure that privacy requirements are known and adhered to. Ensuring comprehensive data integrity may require re-designing data models, conducting data analysis, and mapping and enriching the data to successfully run optimized processes. This must all be executed with minimal disruption to daily business operations.

The data challenge also offers opportunities. In the future, Trustees should find that a lot of the data can be leveraged to create more personalized products. For example, data analytics and business intelligence tools can facilitate the collection and analysis of data on members’ profiles and investment preferences, helping schemes to offer more tailor-made products and services. It should also be possible to make better use of existing schemes’ performance data, creating insightful analytics for members. Using techniques incorporating the latest approaches to data science and Natural Language Processing (NLP), clients can train data models and calibrate them based on business feedback, as well as using data visualization tools to validate outcomes and tailor dashboards.

Optimizing processes

The shift to eMPF is an opportunity to go beyond just data migration and opens options to transform all aspects of today’s compartmentalized and fragmented approaches to MPF administration, employee enrolment, and employer contributions. There are opportunities to achieve cost savings through the robotic process automation of various manual administrative procedures, e.g. the follow-up processes when important notifications are received from the eMPF Platform.

Efficiency and accuracy will improve as unnecessary process steps are identified and removed and today’s processes are handled by either the new platform or the use of robots. With the right approach, even as Trustees use more data to better predict customer needs, automation should allow them to switch talent away from routine data handling and analysis and towards new value-adding operations.

Ensure you are prepared

With the changes fast approaching, it is important that Trustees and MPF administrators are prepared and ready to transition to, share data with, and make good use of, the new platform. The impact on how administrators currently operate and are structured, and the capabilities they will need to have, must be identified and understood. The sooner Trustees start understanding and planning for the changes, the more prepared they will be to ride the eMPF wave and emerge stronger.

For more information, please contact our Capco team.