The European Commission has committed to a fully sustainable economy in Europe. Known as the European Green Deal and set to become Europe’s single largest multi-decade project, the move aims to make Europe the first climate-neutral continent by 2050 and transform the EU economy to ensure environmental and social sustainability.

To achieve this, the European Green Deal investment plan will mobilize at least EUR 1 trillion of sustainable investments over the forthcoming decades, using the financial markets as its intermediary. Specifically, Financing Sustainable Growth will be a key stream of the European Green Deal, as the EU action plan activates the legislative backbone of the financial services industry.

So, what does it mean for financial services firms and their operating models?

ACTING NOW VS HOPING FOR ANOTHER DELAY

Following the global financial crisis in 2008, MiFID II was launched to improve investor protection and market integrity. At the time, it was one of the largest regulatory transformations in Europe. However, the regulators found it surprisingly hard to clarify and provide guidance while market participants fell behind in their approaches to ensure compliance. As a result, the entire legislative package had to be postponed by a whole year.

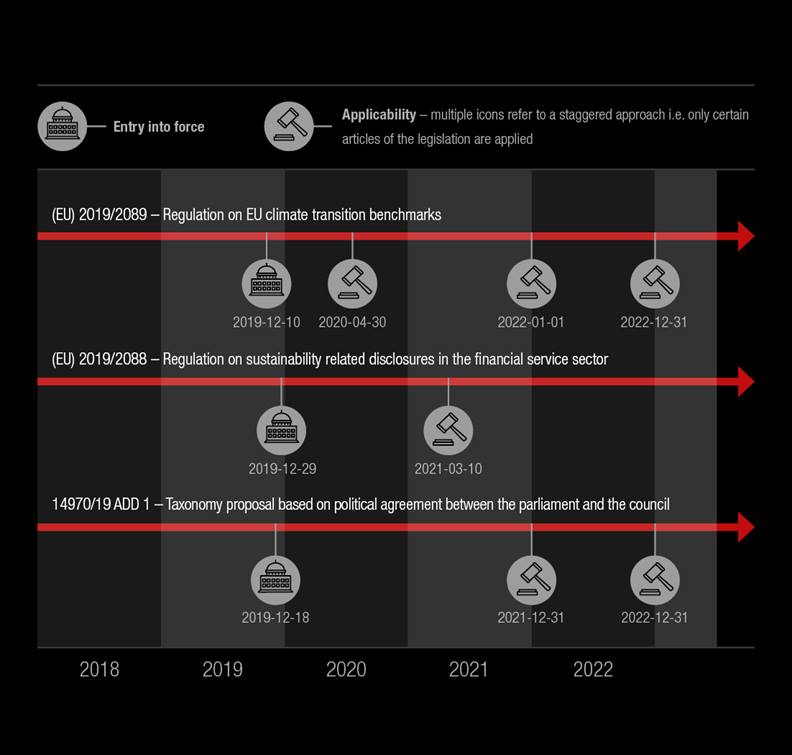

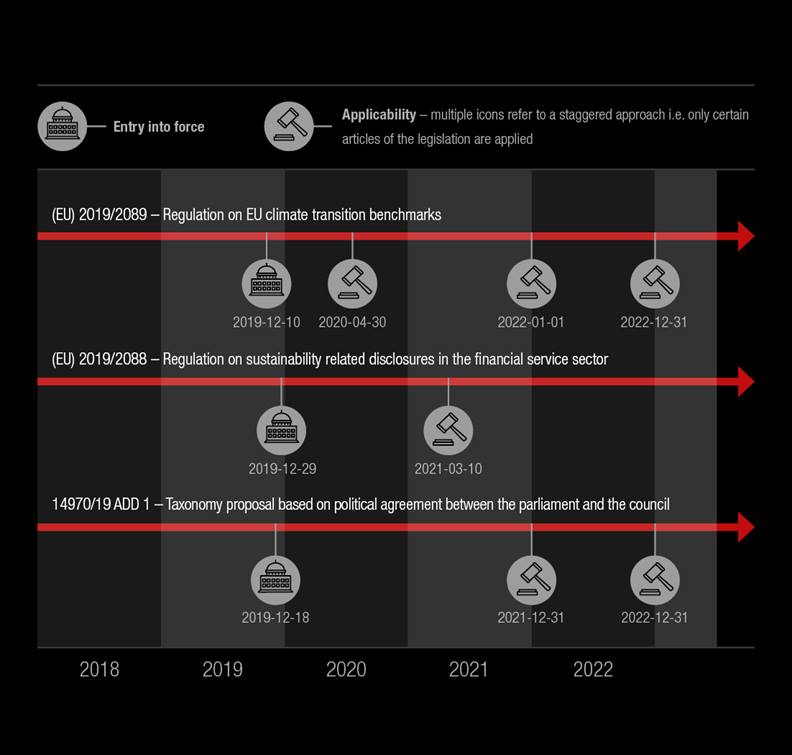

So, how does the Commission action plan fare in comparison? As a matter of fact, the regulation on EU climate transition benchmarks already became partially applicable at the end of April this year, with the regulation on sustainability related disclosures and the taxonomy regulation due to follow in 2021.

The timelines for go-live and applicability of the three regulations are outlined below:

THE IMPACT OF THE EXPECTED REGULATORY CHANGE

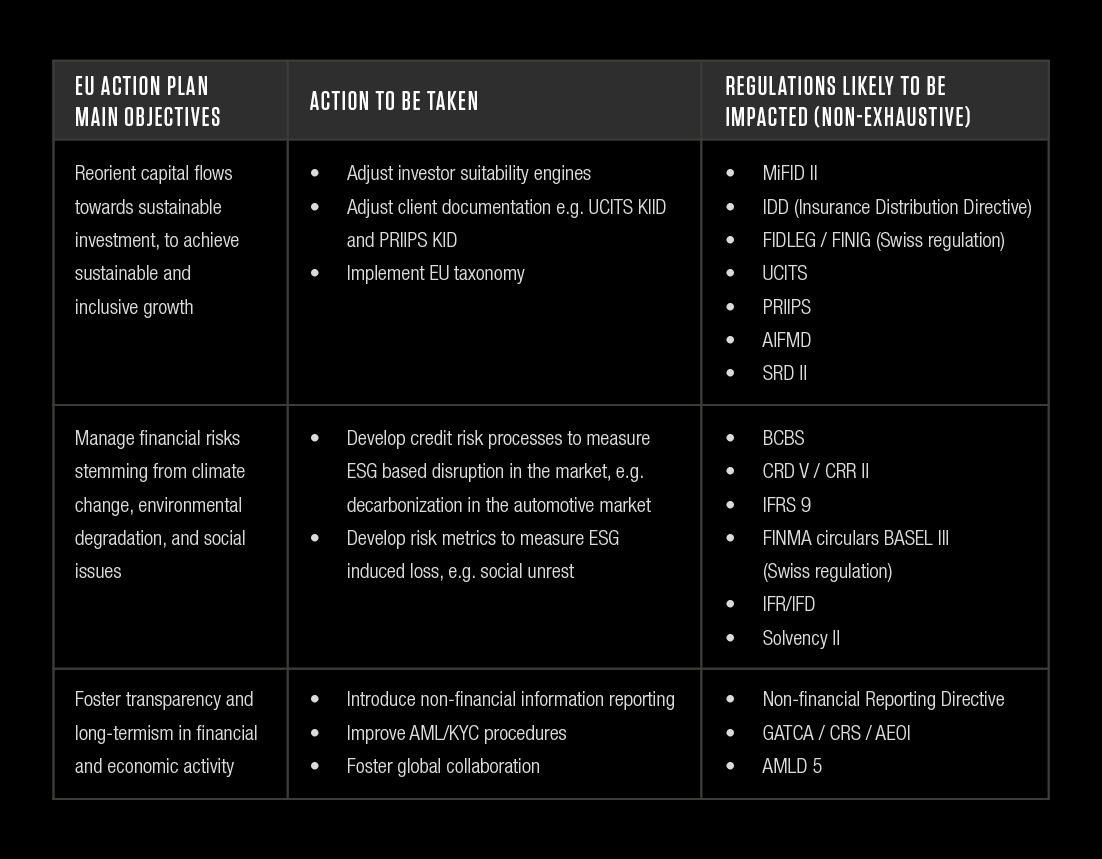

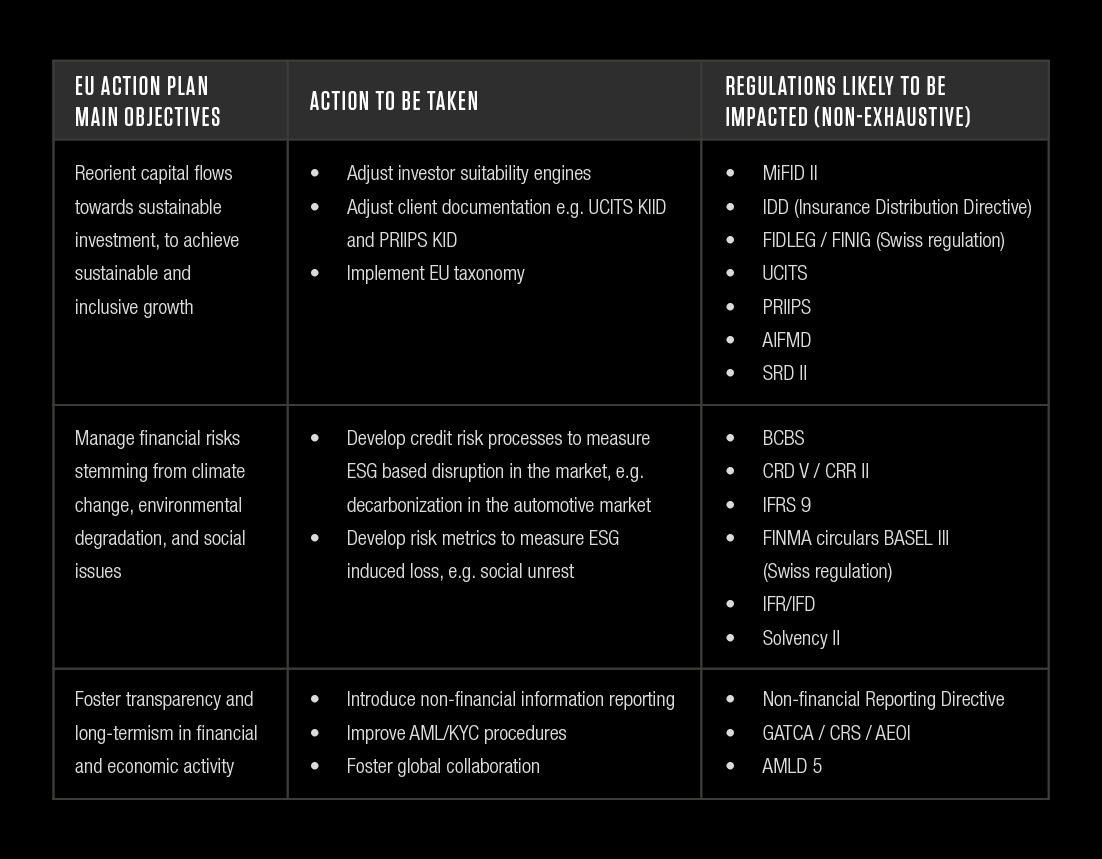

Depending on the role financial market participants play, the ramifications from the EU action plan will vary significantly (e.g. asset manager vs. insurance vs. rating agency vs. bank). Below, we have mapped out the regulatory landscape to provide insight into the first steps needed for planning a response:

NEXT STEPS – A HOLISTIC APPROACH

Capco believes that many financial market participants, particularly in Switzerland, underestimate the impact of the EU action plan to support sustainable finance. While European legislation is, of course, not directly applicable in Switzerland, for many of the global players headquartered in Switzerland the plan will trigger legal obligations through international branches and business activities. Furthermore, Switzerland will likely enact a similar legislation, to avoid jeopardizing access to the single market due to non-equivalence of standards.

While many market players have started to work on isolated topics of the EU action plan, very few holistic projects have been launched to date. Capco recommends that financial market participants urgently shift the attention of senior management to focus on an overarching, strategic approach, starting with the analysis of applicability of the full scope of the upcoming regulatory change across functions, divisions, and entities.

Contact us to discuss in more detail.

CONTACT

Dr. Ingo Rauser, Partner

T +41 44 434 3515

M +41 79 203 5885

E ingo.rauser@capco.com

References

https://ec.europa.eu/info/strategy/priorities-2019-2024/european-green-deal_en

https://ec.europa.eu/info/publications/180308-action-plan-sustainable-growth_en

https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX:32019R2089

https://eur-lex.europa.eu/eli/reg/2019/2088/oj

https://www.consilium.europa.eu/media/41897/st14970-ad01-en19.pdf