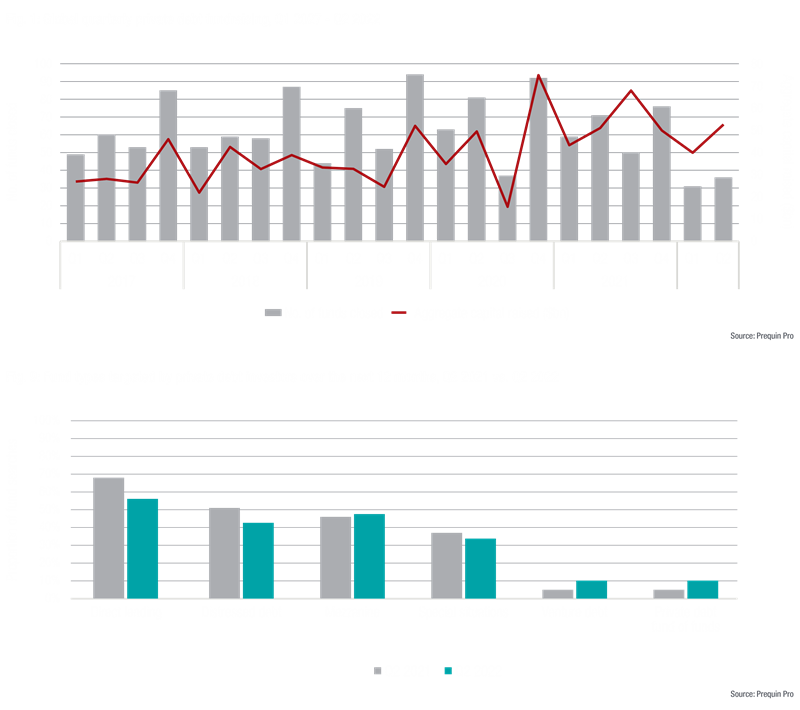

Since 2010s, the direct lending market – illiquid-short-term maturity, floating rate loans to middle-market businesses – has experienced a period of strong growth, consistently outpacing returns over high-yield bonds. This period peaked in 2021 due to historic levels of private equity deal flow and the unique ability of direct lenders to meet the needs of financial sponsors.

More recently this rate of growth has slowed, as credit lending fundraising plummeted amid market volatility and interest rate hikes (see Exhibit 1 below)1. Despite the drop in deal activity, direct lenders have continued capturing market share from other middle-market lending options.

As the market continues to mature and high returns continue to drive interest in direct lending, firms looking to enter or expand in the space can take advantage of the direct lending market as an alternative offering, but must utilize a weighted approach.

Exhibit 1

Firms considering entry into direct lending should consider their capital and legal structure, market position, talent strategy, and the operating model required to support the strategy.

Banks should be cognizant of regulations (e.g., the Volcker Rule) on direct investment in covered funds, which limit the potential avenues to develop a direct lending vehicle through a bank (though there are exceptions to the rule which can allow a bank to operate a fund with either limited ownership or product types). Firms may also be able to leverage a different legal entity or holding company as the fund originator. Each of these options should be evaluated against the bank’s risk appetite and long-term goals.

The capital structure of the offering can be considered through a build, buy, or partner framework. The decision will depend on a firm’s current access to borrowers and investors, operational and technology infrastructure, and long-term business vision as well as an analysis of the size and volume of deals made for capitalization strategy.

Any market entry strategy must include a detailed consideration of where the firm is best placed to succeed in the marketplace, including the following factors:

Banks must ensure the appropriate skillsets and human capital are in place, including highly qualified management teams to source opportunities and oversee the allocation of capital in middle-market debt funds. Hiring experienced leadership can quickly build the required credibility and scale to compete with incumbent direct lenders, as well as adding significant value to potential partnerships.

While marketing and salespeople are key for some firms, other banks may require enhancments to back and middle office teams. Some firms will require legal and regulatory expertise to manage the complexities associated with establishing a separate legal entity.

Entry into direct lending may utilize a large portion of the firm’s existing capabilities. Any established operating model should be assessed to determine gaps and identify opportunities to support that entry. Given the potential complexities related to each entry option, the operating model should consider relative strengths of, and the resources needed to implement, each option, The goal is to achieve the following outcomes:

Firms that are considering entering into direct lending must establish a clear vision, define their goals, and assess the playing field. The following questions can guide them in their journey.

What are your vision and goals? Develop a long-term vision for the new offering and establish both financial and non-financial goals that will guide your decision making.

Where should you to play? Assess the market outlook with an understanding of core competencies of competitors as well as your firm and identify gaps in the market. Consider potential methods of market entry (e.g. capital and legal) partnerships or other forms of delivery.

How can you win? Assess and select change opportunities based on your vision, market assessment, risk tolerance, and overall appetite for change. Identify the tactical actions required to realize your strategy.

What roadmap you should execute? Align costs and benefits to each change initiative highlighting interim milestones and quick wins. Identify investment needs in respect of additional talent, operating model changes, and technology enablement.

Capco has extensive experience in helping firms navigate these shifting trends and has the proven expertise to navigate an array of market conditions. If you are considering launching or expanding a direct lending offering, please reach out to us.

Sources

[1] Preqin Private Debt Update Q2 2022