China’s e-CNY, the digital form of the renminbi issued by the People’s Bank of China, is front and center of an intense global conversation about central bank digital currencies (CBDC).

Proponents of CBDCs say they could offer a way to reduce cash and payments costs and frictions, improve financial inclusion, support monetary policy, and encourage further digital innovation – while avoiding many of the risks associated with private cryptocurrencies.

With over 90% of the world’s central banks researching or looking into creating and deploying CBDCs,1 e-CNY is attracting attention as one of the first CBDCs to be put into public use – along with the much smaller-scale Bahamas’ Sand Dollar and Jamaica’s JAM-DEX. Through an expanding series of pilot studies in China, the e-CNY is already being used to pay for retail purchases, bus and subway tickets, and other services.2

While the e-CNY is legal tender, it has a long way to go in terms of ensuring mass adoption. However, by end 2021, 261 million digital wallets had been opened, and by end August 2022 the digital currency had accumulated more than RMB 100 billion in transaction value.3 In January 2023, the e-CNY was for the first time included in PBOC’s financial statistics report (for 2022), which noted that e-CNY worth 13.6 billion yuan (US$2 billion) were in circulation.4 New e-CNY features – offline contactless payment and various smart contract functions were enabled in later 2022 and early 2023 – should help accelerate e-CNY uptake.

While the architectures and goals of CBDCs will differ around the world – and China’s digital currency environment is unusual in prohibiting trading in private cryptocurrencies – e-CNY’s progress is throwing light on how CBDCs could shape the future of retail payments.

IMPLICATIONS FOR BANKS

The potential growth in the adoption and use of CBDCs has many implications for banks. In particular, while most Asia-Pacific economies are still some distance from being cash-free, the launch of CBDCs is likely to speed up the adoption of cashless payments. Although most CBDCs are designed to act as physical cash substitutes, CBDCs could in the longer term threaten bank payments and deposits businesses more broadly.

One of the foundations for conducting CBDC transactions, including e-CNY, is the broad adoption of digital wallets. Digital wallets, increasingly important to Asia-Pacific financial services, will therefore be part of the basic infrastructure that financial institutions must master to compete in any new CBDC-oriented economic landscape.

The key role of banks in the evolving digital currency landscape will be to act as distributors and service providers. It will be crucial for banks to understand how they can provide CBDC payment services that provide an excellent user experience if they are to compete with their peers and emerging competitors (fintech and ‘Big Tech’ companies).

In China, between the launch of e-CNY in April 2020, and December 2021, more than 50 third-party platforms that support e-CNY as a means of transaction were recorded.5 As China’s pilot stage matures, the number of fintech firms exploring innovative use cases for CBDC will grow. Shifts in the technologies that utilize digital currencies, and changes to the regulation around digital currencies and digital assets, will create challenges for banks as well as for Alipay and WeChat Pay, currently the dominant players in the digital wallet market.

The adoption of e-CNY will bring the need for improvements further down the line, for example, in terms of the need to digitalize and strengthen online banking capabilities, and engineer interoperability between offline teller machines and e-CNY. The improvements will be supported by more personalized and secure financial data management systems, leveraging emerging technologies such as biometrics and blockchain.

China’s progress on e-CNY has focused interest on a range of future use cases for CBDC, globally and within the Asia-Pacific region, three of which we will now discuss.

Use Case (1): Tax Payment through CBDC

Payment interactions with the government will be a huge part of how CBDCs deliver value, and the most widely anticipated use case concerns paying taxes. Here, the benefits of CBDCs include lower costs and more timely transactions, with fewer human interventions. For example, programmable payments will allow automated tax payments from consumer spending transactions to be routed direct to government authorities.

This ‘tax payment-made-easy’ aligns with the ambition of many Asia-Pacific countries to improve financial inclusion and diminish barriers for lower income households. CBDC tax payments can be enabled and promoted through policies such as civil servants receiving salary payments in the form of CBDC, or through applying economic stimulus by distributing CBDC.

The use of CBDC offers benefits beyond efficiency and speed, for example, in terms of improving the filing of tax returns and helping to prevent tax evasion. However, CBDCs can also allow the authorities to monitor financial transactions and this has led to concerns regarding financial data privacy.

Columbia is a country experiencing significant tax evasion issues that has spoken about the potential advantages of CBDC. The head of the Colombian Tax and Customs Office, Luis Carlos Reyes, mentioned the country is considering the use of CBDC for tackling tax evasion: “One of the important objectives is that when payments are made for a certain amount, they will be recorded on an electronic medium.”6

Use Case (2): Programmable Money

Long before CBDCs began to be seriously explored, digital currencies such as bitcoin brought to light various use cases for programmable money and smart contracts, including risk management, global transactions, and atomic payments.

For example, large payments such as real estate purchases often require a third party to hold the money until payment terms have been met. Digital currencies, including CBDCs, potentially remove the need for the intermediary, with the CBDC programmed to be released to the seller after all the terms of the sales contract have been met. Programmable money may represent the future for a wider set of business and personal transactions and, at the extreme, opens up the possibility of a decentralized bank-less future.

The concept of programmable money helps to highlight the social risks that might arrive alongside CBDCs. Programming specific rules within a digital currency can be used to

constrain the user of the currency. For example, central banks could use CBDC to offer consumption vouchers with an expiration date, as a way of timing any economic stimulus.

Less benignly, CBDCs potentially also allow central banks and the government to monitor and restrict certain types of spending, or spending by certain categories of the public. The limitations imposed might range from banning spending on a particular type of food, to restrictions on buying travel tickets, or the targeting of subsets of the population, ranging from those committing crimes, to policy violators, or individuals of low credit rating.

In principle, this kind of action is not restricted to digital currencies, as law enforcement officials around the world can already try to freeze the bank accounts of individuals. However, CBDCs could make it easier to target larger numbers of people or certain types of spending.

Use Case (3): Risk Management with CBDC

Banks invest considerable sums around the world in anti-money laundering (AML) activities and in combatting terrorist financing (CTF). The launch of CBDCs may mean that financial institutions are expected to apply more advanced KYC (Know Your Customer) methodologies due to the easily transferable nature of the digital asset.

Money transfers and payments are much easier when using a digital currency, especially for cross-border payments, so it is essential to maintain a high standard of KYC during the digital wallet opening process. However, CBDCs based on distributed ledger technology (DLT) also have the potential to bring numerous benefits to AML

and CTF. In principle, the adoption of CBDC provides an audit trail in terms of the digital records of financial transactions and digital records of public on-chain wallets, providing traceability to regulatory parties and financial intermediaries, and simplifying risk monitoring and oversight.

It is likely that there will be a unique wallet for each CBDC holder, making it possible to trace CBDC holdings and transactions. Although in China, second-tier institutions hold the responsibility for circulating the e-CNY, most CBDC are still in their early stages of design and it will not be clear who has the responsibility for this kind of risk management before each system design is finalized.

The system design of each CBCD will determine the degree to which it preserves anonymity. China’s e-CNY applies a managed anonymity approach, which will create “anonymity for small value and traceable for high value”.7 On the other hand, the National Bank of Cambodia’s Project Bakong is a blockchain-based nationwide payment system that uses a token-based approach, 8 which will tend to preserve anonymity, while applying a transfer limit as a replacement form of control.

CONCLUSION

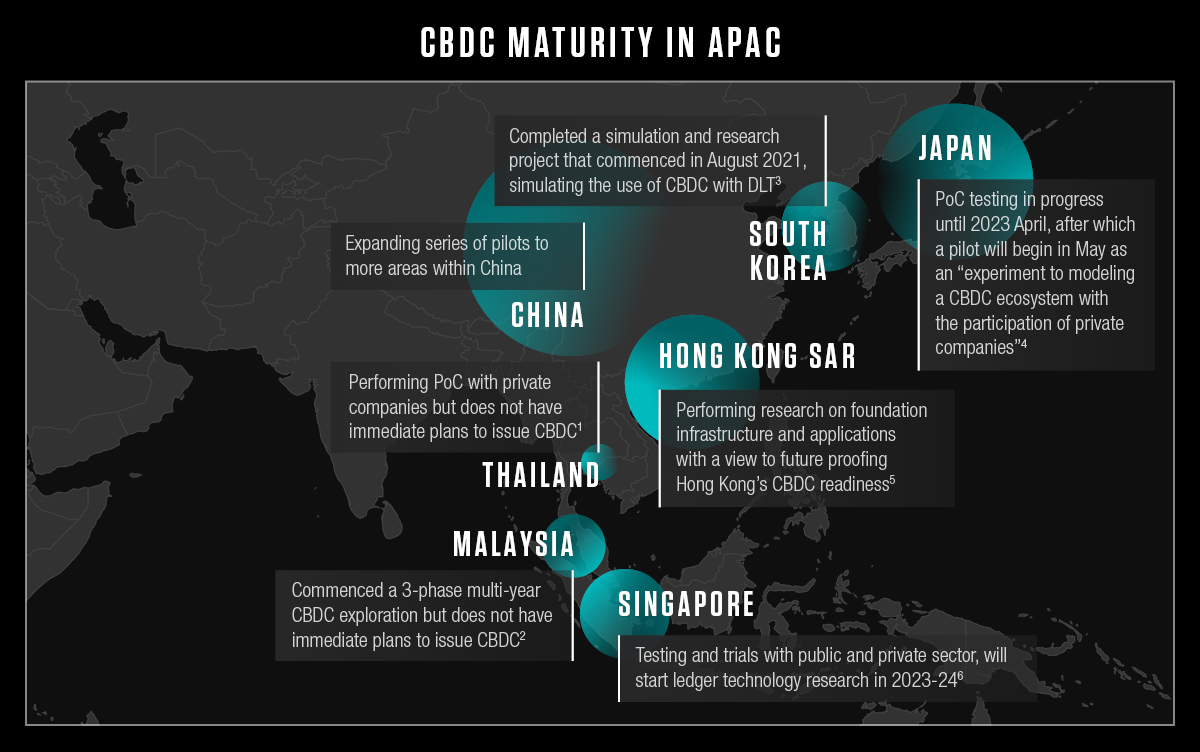

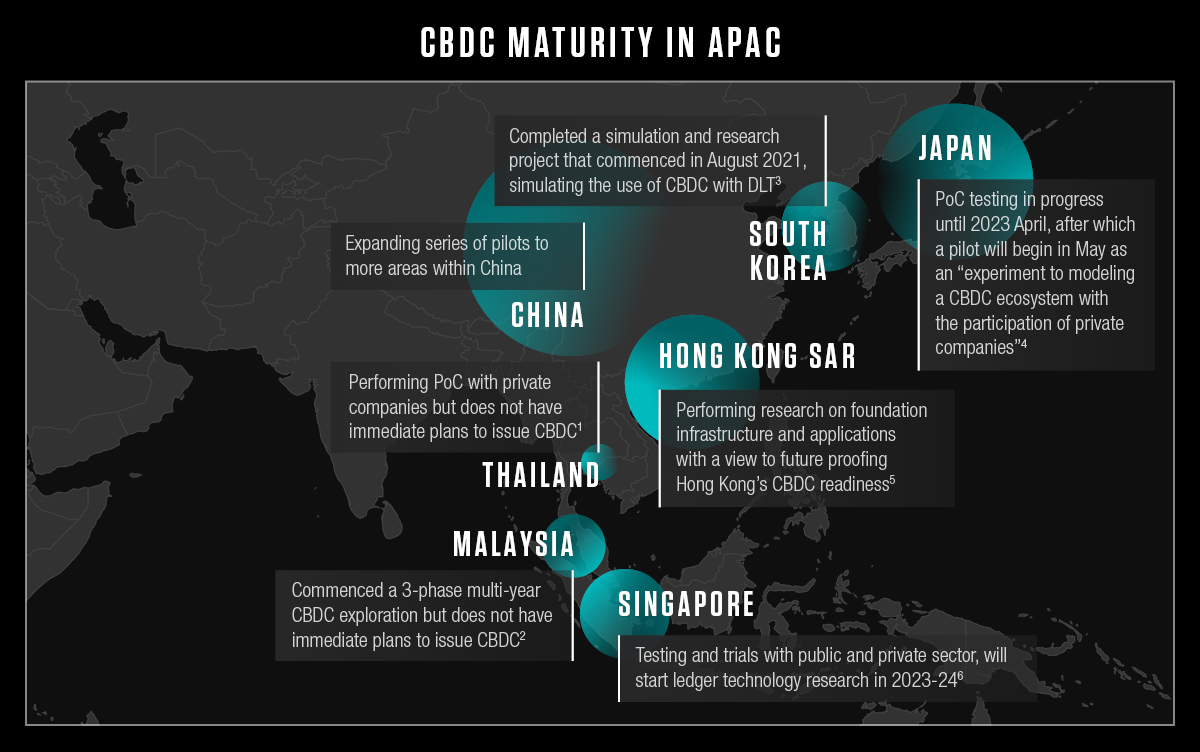

China is pushing ahead with its ambitious e-CNY project by expanding pilot testing to more cities and regions. While China is in the lead, a recent IMF report noted that the Asia-Pacific region as a whole is “at the forefront of CBDC exploration” with India and Thailand at “advanced stages” of development, and others such as Malaysia and Singapore in the experimental or proof of concept stages.9

CBDCs are a natural evolution of traditional finance and, over time, the launch of further CBDCs, and an increase in their adoption by the public, seems highly likely, with the prevalence of the use cases mentioned in this article depending on the degree of adoption and the precise nature of each CBDC. Despite the controversies and potential risks surrounding CBDCs, they could create numerous opportunities for the financial industry and offer a conduit for attracting wealth from banking customers through public service payments, cross-border payments, and peer-to-peer payments.

However, with digitally savvy Asia-Pacific consumers already able to achieve cashless, real-time payments, CBCD will need to be innovative and address trust and data privacy concerns. Furthermore, integration into larger super app service ecosystems, e.g. WeChat and Alipay in China, may prove critical. Commitment from the private sector, i.e. financial institutions, is likely to prove crucial to attracting users and engineering the right balance between security and user experience. Banks will also want to consider the potential risks that could arise from the design of each CBDC, for example, the danger of a flight to safety away from bank deposits and toward the local CBDC during a future financial panic.

In some countries, selecting the right approach to CBDCs may determine whether the bank becomes a leader or a follower in terms of its digital strategies. As a next step, banks need to review their current technology capabilities in the light of emerging CBDCs to identify gaps, for example, in terms of building optimal future customer journeys in payments and investing. Well before CBDCs win mass adoption, banks should be re-imagining their user experience and how they design digital services, and investing in innovation and a future-ready tech stack that can support the shift to a CBDC-oriented economy.

1. Ensuring adoption of central bank digital currencies – An easy task or a Gordian knot? https://www.ecb.europa.eu/pub/pdf/scpops/ecb.op307~c85ee17bc5.en.pdf

2. Deep Dive | China’s growing e-CNY industry is reshaping the future of digital payments https://kr-asia.com/deep-dive-chinas-growing-e-cny-industry-is-reshaping-the-future-of-digital-payments

3. China’s digital currency: transactions total 100 billion yuan at end of August https://www.scmp.com/tech/policy/article/3195744/china-digital-currency-transactions-total-100-billion-yuan-end-august

4. PBOC, Financial Statistics Report (2022), January 10, 2023 http://www.pbc.gov.cn/en/3688247/3688978/3709137/4765043/index.html

5. Deep Dive | China’s growing e-CNY industry is reshaping the future of digital payments https://kr-asia.com/deep-dive-chinas-growing-e-cny-industry-is-reshaping-the-future-of-digital-payments

6. Gobierno Petro buscará “la creación de una moneda digital”, confirma el director de la Dian

https://www.semana.com/nacion/articulo/gobierno-petro-buscara-la-creacion-de-una-moneda-digital-confirma-el-director-de-la-dian/202209/. Quotation is translated.

7. China Launches Digital Yuan App – All You Need to Know

https://www.china-briefing.com/news/china-launches-digital-yuan-app-what-you-need-to-know/#:~:text=What%20is%20e%2DCNY%3F,Bank%20of%20China%20(PBOC)

8. Bakong Official Launch, Press Release, SORAMITSU https://soramitsu.co.jp/bakong-press-release

9. Towards Central Bank Digital Currencies in Asia and the Pacific: Results of a Regional Survey

https://www.imf.org/en/Publications/fintech-notes/Issues/2022/09/27/Towards-Central-Bank-Digital-Currencies-in-Asia-and-the-Pacific-Results-of-a-Regional-Survey-523914