A NEW EVOLUTION OF INSURANCE USER EXPERIENCES

- Published: 11 September 2019

First came manuals, then aggregators and finally portals

Wait, portals? Is that where the story ends?

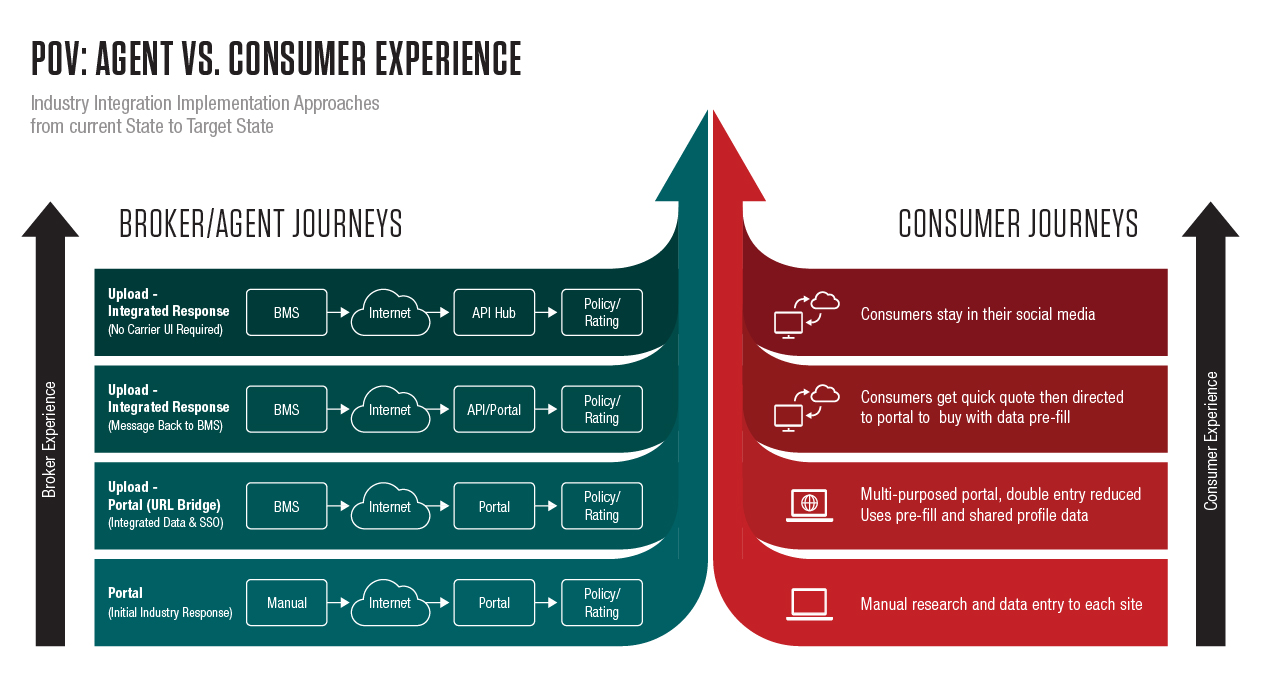

Portals initially solved issues plaguing the insurance industry –reduced printing, mail, and courier costs and streamlined data entry. However, brokers and agents cried out – double entry wasn’t solved, just shoved into a different part of the workflow. Portals then extended web-bridging to solve Single Entry Multi Carrier Interface (SEMCI) issues. Data captured once in the broker/agent system could now be uploaded to any rating interface or portal.

However, striving to provide unique product offerings, portals allowed carriers new data capture and validations eroding SEMCI benefits. Soon, SEMCI portal efficiencies would be lost. Brokers and agents work in unique carrier portals sacrificing a globalized experience for expediency within each carrier.

Meanwhile, brokers’ systems become simply a book of record instead of the complete office management systems the vendors promoted. Return on investment lags as brokers and agents use portals rather than their own optimized workflows.

Its time for new experiences

User interfaces (UI) still have a valuable role for the user to experience how they interact with different organizations, but the interactions can be deeper and more binding than UI experience alone.

Direct-to-consumer insurance offerings are starting to simplify the up-front data capture, reducing the burden pushed onto the consumer. However, products have been commoditized and de-personalized to meet the ‘best overall fit’ vs. the ‘best for the client fit.’

Why now?

Both the distribution channel and the insurance coverage carriers are under threat from InsurTechs. In order to prove their solutions viable, many InsurTechs are not sticking to technology. Instead, by developing insurance companies and distribution offerings, they opt to directly challenge the legacy insurers.

Additionally, consumer expectations of mobile, 24/7 access, ease-of-use, and self-service or assisted service are changing and becoming table-stakes.

Products and insurance needs are changing with new parametric insurance solutions, cyber exposures and shifting liabilities with artificial intelligence, autonomous vehicles and new Internet of Things (IoT) data that modify the risk management and definitions.

The art of the possible

Let’s re-imagine user experiences unbounded by portal interfaces.

New API integration offerings,

micro-services and third-party data sources are allowing sales, underwriting

and claims teams to augment data and use prescriptive and predictive analytics,

creating better experiences.

By leveraging data, the insurance industry has an opportunity to create incredible user experiences. While house or car shopping, quick quotes are delivered right to your social media feed. Users stay in their social media while validating permissions and additional data to move from quick quote to full rating and even to the sale.

Data capture questions become about risk tolerance and appetite. Coverage fit becomes trendy again ensuring exposure and coverage's are matched and tailored to the individual.

Brokers and agents can leverage their data even further. Bulk portfolio and scenario sensitivity analysis for re-marketing and renewing risks. The same third-party data and predictive analytics fill in the data gaps. Dashboards quickly display risk reviews and identify market exposures, appetites and rating.

How do we get there?

It’s time the insurance industry took an actual user experiences outlook on industry workflows. From consumers, brokers and agents to underwriters, adjusters, and back-office teams. Re-aligning actuary market segmentation with sales experiences to ensure the right business flows to the right carriers.

Brokers and agents need to leverage their systems and provide value-add services and adapt to changing consumer expectations.

Business and IT teams should have a vision and implement the components constructing that visionary journey instead of dealing with each pain point and pushing the final vision off the drawing board. The vision helps unite the different teams towards a common objective and provides a baseline to measure progress.

Portals aren’t the ending. They were a step in the journey. Given the changing technology and new opportunities, it’s a great time to make quicker, shorter steps and show visible progress to an overall better experience for our industry.