Consumer

Helping you put customers at the heart of what you do. Protect Consumer Duty - Transform Customer Experiences - Reimagine Innovation.

The rise of fintechs and non-traditional industry players, constant regulatory change and dynamic customer expectations are redefining banking as we know it. Overlaying these pressures with constantly evolving technology, it is now imperative for banks to be nimble and rapidly adapt to change or they risk being left behind.

Capco’s banking experts provide digital transformation services to grow banks’ retail, commercial and corporate offerings, supporting them along an agile and customer-focused journey.

The payments landscape is constantly shifting, with the emergence of complex regulatory standards, such as ISO 20022, significant M&A activity, and drastic changes to how merchants and consumers transact – from the prolificacy of CNP (Card Not Present) and contactless to tokenized payments.

Capco provides comprehensive advisory expertise across the end-to-end payment delivery cycle from customer journey, card issuance and acceptance solutions to payments architecture and delivery and payments modernization.

Open banking is globally evolving, with the focus of re-energizing the banking and payments landscape for both businesses and consumers. This global trend is providing consumers more choice and control over how their money and financial information is used and shared.

Capco provides businesses with the tools and expertise to capitalize on the vast array of opportunities which have arisen in the open banking era. Possessing technological acumen and deep market and consumer insight, Capco helps clients to leverage open banking to retain and grow their customer base.

Community banking is vital to the financial system and the broader economy, from lending to consumers, small business owners, and farmers, to providing banking services to members and customers in small towns and rural communities.

LEARN MORESUCCESS STORY

Capco was engaged to create a growth strategy and associated roadmap for the credit union's credit card and personal lending business

LEARN MORE

SUCCESS STORY

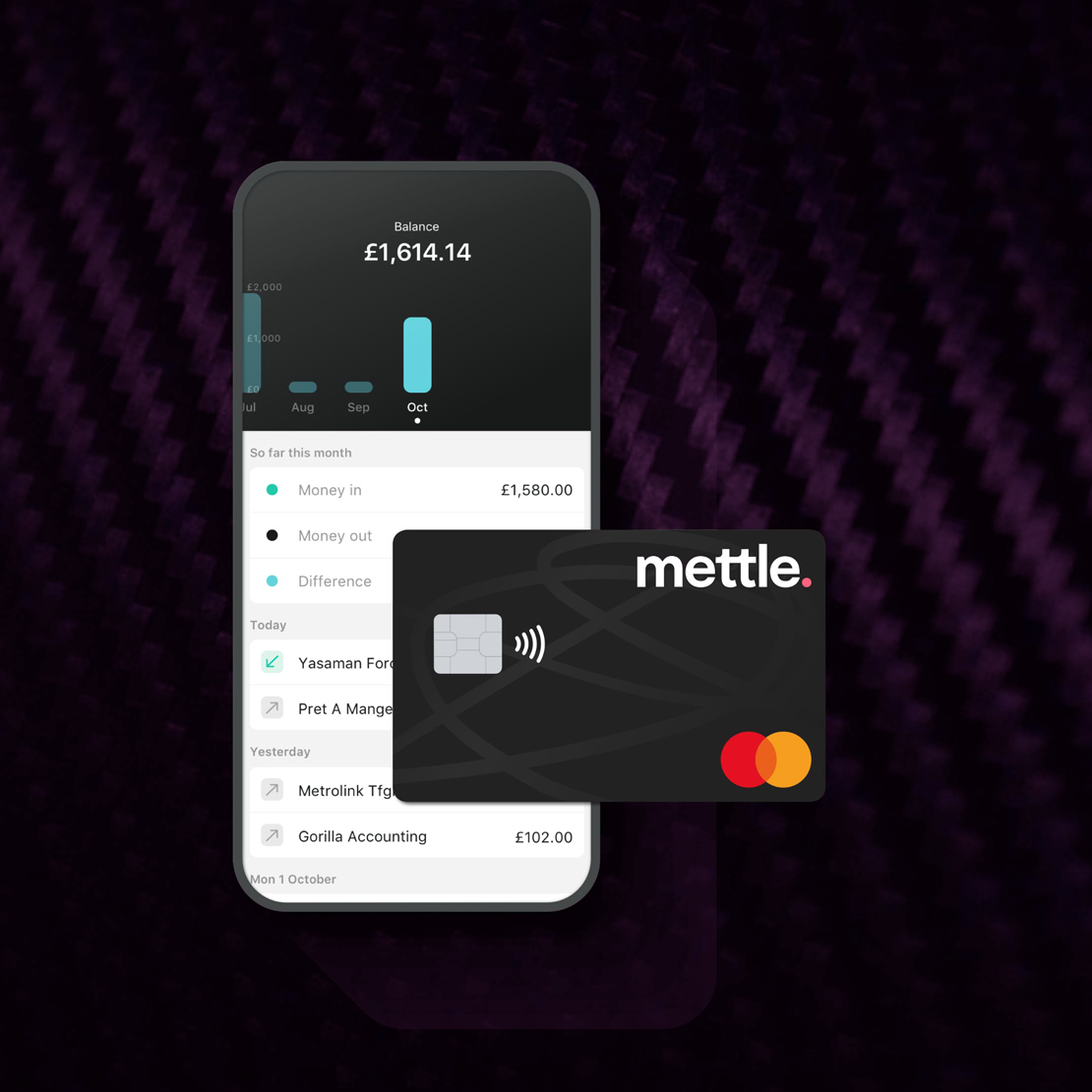

How Capco partnered with Natwest to create a new breed of bank for businesses, Mettle

learn MORE